Galxe, the latest digital currency to hit the market, has taken the world by storm. With its innovative technology and promising potential, Galxe has become the talk of the town among investors and traders alike. But how can you make the most out of this exciting opportunity? The answer lies in live chart analysis of price trends.

Live chart analysis allows you to unlock the hidden patterns within Galxe’s price movements, enabling you to make informed decisions and maximize your profits. By studying the real-time data and visual representations of Galxe’s price fluctuations, you can identify key trends, patterns, and support/resistance levels. This invaluable information not only helps you anticipate price movements but also allows you to time your buys and sells strategically.

The beauty of live chart analysis is that it provides you with a comprehensive and holistic view of Galxe’s price dynamics. By incorporating various technical indicators such as moving averages, MACD, and RSI, you can gain a deeper understanding of market sentiment and momentum. This enables you to ride the trend, enter at opportune moments, and exit before the trend reverses.

Moreover, live chart analysis empowers you with the ability to spot potential reversals or breakouts in Galxe’s price. By identifying key support and resistance levels, you can anticipate when the price is likely to change its direction. This allows you to capitalize on these market turning points and make profitable trades.

So, if you want to unlock the full potential of Galxe and take advantage of its price trends, live chart analysis is the way to go. Stay ahead of the game, make informed decisions, and maximize your profits with this powerful tool. Don’t miss out on the opportunity to harness the power of live chart analysis and make your mark in the world of Galxe trading.

Unlocking the Potential of Galxe: Live Chart Analysis

Galxe is a promising cryptocurrency that has caught the attention of many investors and traders. In order to unlock its full potential, it is essential to conduct live chart analysis of price trends. By analyzing the charts, we can gain valuable insights into the market behavior of Galxe and make informed decisions.

Why Live Chart Analysis?

Live chart analysis allows us to track the price movements of Galxe in real-time. It provides us with a clear visualization of how the market is behaving and helps us identify patterns and trends. By studying these charts, we can develop strategies and make well-timed trades, maximizing our profit potential.

Key Factors to Consider in Live Chart Analysis

When analyzing Galxe’s live charts, there are several key factors to consider:

- Price Movements: Tracking the price movements of Galxe is crucial. By identifying support and resistance levels, we can determine potential entry and exit points.

- Volume: Volume is an important indicator of market strength. Analyzing the trading volume can help us identify trends and confirm price movements.

- Technical Indicators: Utilizing technical indicators such as moving averages, Bollinger Bands, and RSI can provide additional insights into price trends and potential reversals.

- Market News: Keeping an eye on market news and events can help explain sudden price movements and provide context to chart analysis.

By considering these factors, we can conduct a comprehensive live chart analysis of Galxe and make informed trading decisions.

Overall, live chart analysis is a powerful tool that can unlock the potential of Galxe. By studying the charts and considering various factors, we can gain insights into price trends and make strategic moves to optimize our investment.

Understanding the Galxe Market

The Galxe market is a dynamic and evolving industry that has attracted significant attention in recent years. With the rise of cryptocurrency and blockchain technology, Galxe, a digital currency, has emerged as a prominent player in the market.

What is Galxe?

Galxe is a decentralized digital currency that operates on a peer-to-peer network. It is based on blockchain technology, which ensures transparency, security, and immutability of transactions. Unlike traditional fiat currencies, Galxe is not regulated by any central authority such as a government or financial institution.

Benefits of Galxe

Galxe offers several benefits that set it apart from traditional financial systems. First and foremost, it provides users with full control over their funds without the need for intermediaries. This eliminates the risk of fraud or financial censorship.

Additionally, Galxe offers faster transaction times compared to traditional banking systems. Transactions can be processed within minutes or even seconds, regardless of geographical location.

Galxe also boasts lower transaction fees compared to traditional banking systems. This makes it an attractive option for individuals and businesses looking to save money on transaction costs.

Volatility and Price Trends

It’s important to note that Galxe, like other cryptocurrencies, can be highly volatile. Price fluctuations can be significant within short periods of time, making it a potentially risky investment.

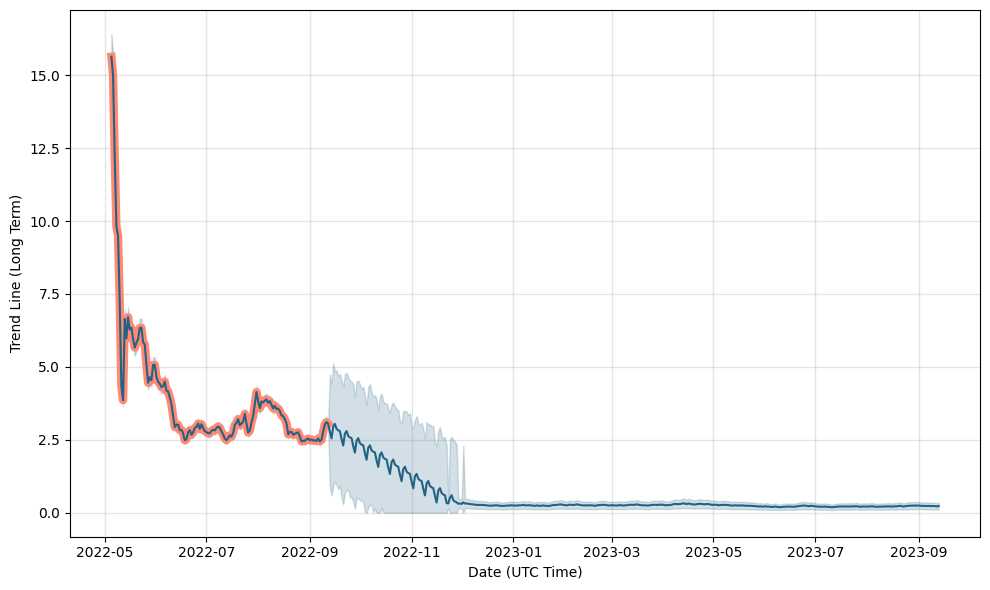

Understanding the price trends of Galxe is crucial for investors looking to make informed decisions. Live chart analysis can help identify patterns and trends, allowing investors to assess risks and predict potential future price movements.

Investors should exercise caution and conduct thorough research before engaging in Galxe trading or investment.

Conclusion

The Galxe market presents an exciting and potentially lucrative opportunity for investors. However, it is essential to have a solid understanding of the market dynamics, benefits, and risks before engaging in Galxe trading or investment. Utilizing live chart analysis can help investors make informed decisions and maximize their potential for success.

Live Chart Analysis: Identifying Price Trends

In the fast-paced world of global markets, being able to identify price trends in real-time can be a crucial skill for traders and investors. Live chart analysis allows individuals to monitor and analyze price movements to make informed decisions about buying or selling assets.

Technical Analysis Tools

One of the key components of live chart analysis is the use of technical analysis tools. These tools help traders and investors identify trends, patterns, and other important indicators in price charts. Some common technical analysis tools include:

- Trendlines: These lines are drawn on a price chart to highlight the direction of the trend. They can be used to identify support and resistance levels.

- Moving Averages: Moving averages are used to smooth out price data and identify trends over a specified period. They can help traders identify when a trend is reversing or strengthening.

- Relative Strength Index (RSI): The RSI is a momentum oscillator that measures the speed and change of price movements. It can help traders identify overbought or oversold conditions.

- Japanese Candlesticks: Candlestick charts provide a visual representation of price movements. They can help traders identify patterns and trends based on the shape and color of the candles.

Identifying Bullish and Bearish Trends

By using live chart analysis and technical analysis tools, traders and investors can identify bullish and bearish trends in the market.

A bullish trend is characterized by a series of higher highs and higher lows. This indicates that buyers are in control, pushing prices higher. Traders may look for buying opportunities or hold onto their long positions during a bullish trend.

On the other hand, a bearish trend is characterized by a series of lower highs and lower lows. This indicates that sellers are in control, pushing prices lower. Traders may look for selling opportunities or consider short positions during a bearish trend.

Identifying these trends in real-time allows traders to devise strategies and make decisions based on the current market conditions. By staying informed and utilizing live chart analysis, traders can increase their chances of success in the ever-changing world of global markets.

Utilizing Price Trends for Profitable Trading

Price trends play a crucial role in the world of trading and investing. By understanding and analyzing these trends, traders can make profitable decisions and optimize their strategies. Whether you are a novice trader or an experienced investor, utilizing price trends can greatly enhance your success in the market.

The Power of Technical Analysis

Technical analysis is a widely used method for analyzing price trends. It involves studying historical price and volume data to identify patterns and trends. These patterns can then be used to predict future price movements and make informed trading decisions. By utilizing technical analysis, traders can gain valuable insights into market behavior and increase their chances of making profitable trades.

There are various tools and indicators available for technical analysis, such as moving averages, trendlines, and oscillators. These tools help traders identify support and resistance levels, trend reversals, and potential entry and exit points. By combining multiple indicators and analyzing price trends from different timeframes, traders can further increase their accuracy and profitability.

Staying Informed and Adapting

Price trends are not static and can change rapidly. Traders should stay informed about market news, economic events, and company announcements that may impact price movements. By keeping an eye on these factors, traders can react quickly to new information and adjust their trading strategies accordingly.

It is important to note that not all price trends are reliable indicators of future movements. Traders should be cautious and not solely rely on a single trend or indicator. It is advisable to combine multiple indicators and perform thorough analysis before making trading decisions.

Conclusion

Utilizing price trends for profitable trading requires a combination of technical analysis, staying informed, and adaptability. By studying historical price data and using various tools and indicators, traders can predict future price movements and improve their chances of making profitable trades. However, it is essential to constantly monitor and analyze trends, and not solely rely on a single indicator or trend. Successful traders are those who can identify and adapt to changing market conditions, maximize opportunities, and minimize risks.

Taking Advantage of Galxe’s Potential

The potential of Galxe in the market cannot be overstated. With its innovative technologies and strong leadership, Galxe is poised to make a significant impact in the industry. As an investor, you have the opportunity to take advantage of this potential and maximize your returns.

To make the most of Galxe’s potential, it is important to stay informed about the latest trends and developments in the market. Regularly analyzing Galxe’s live price chart can provide valuable insights into the price trends and help you make informed investment decisions.

Live Chart Analysis

Performing live chart analysis allows you to identify patterns and trends in Galxe’s price movements. By examining the historical data and studying various technical indicators, you can gain a better understanding of the market sentiment and make more accurate predictions about future price movements.

When analyzing Galxe’s live chart, it is important to consider key indicators such as support and resistance levels, moving averages, and trend lines. These indicators can help you identify potential entry and exit points, as well as determine the overall strength of the trend.

Risk Management Strategies

While Galxe presents a promising opportunity, it is important to remember that all investments carry a certain level of risk. Therefore, implementing effective risk management strategies is crucial to protect your investment capital.

Diversification is one key strategy that can help mitigate risk. By spreading your investment across different assets, sectors, or geographical regions, you can reduce the impact of any single investment on your overall portfolio.

Additionally, setting a clear stop-loss level can help protect your investment from significant losses. A stop-loss order automatically closes your position if the price of Galxe reaches a certain predetermined level, limiting your potential losses.

In conclusion, Galxe’s potential is evident, and by taking advantage of it through live chart analysis and implementing effective risk management strategies, you can position yourself for success in the market. Remember to stay informed, analyze the data, and make informed investment decisions to maximize your returns in this exciting opportunity.

Question-answer:

What is Galxe and how does it work?

Galxe is a digital currency that operates on a blockchain network. It is a decentralized cryptocurrency that allows users to make transactions securely and anonymously. The transactions are recorded on the blockchain, which is a transparent and immutable ledger.

What is live chart analysis of price trends?

Live chart analysis of price trends is the process of analyzing the historical price data of an asset using charts in real-time. It involves studying the patterns and trends in the price movement of an asset to predict future price movements. This analysis can help traders make informed decisions about buying or selling assets.

How can live chart analysis of price trends help traders?

Live chart analysis of price trends can help traders by providing them with insights into the future price movements of an asset. By studying the historical price data and identifying patterns and trends, traders can make informed decisions about when to buy or sell assets. This analysis can help them maximize profits and minimize losses.

Is live chart analysis of price trends accurate?

The accuracy of live chart analysis of price trends depends on various factors, such as the quality of the data, the methodology used, and the experience and skill of the analyst. While it is not a foolproof method, it can provide valuable insights and increase the chances of making profitable trades.

What are some common patterns and trends that can be identified through live chart analysis of price trends?

Some common patterns and trends that can be identified through live chart analysis of price trends include support and resistance levels, trend lines, chart patterns such as triangles and head and shoulders patterns, and indicators such as moving averages and oscillators. These patterns and trends can provide valuable information about the future price movements of an asset.