Experience the future of insurance with Galxe 2.0, the cutting-edge platform that is transforming the industry. Our AI-driven solutions empower insurance companies to operate with unprecedented efficiency, accuracy, and speed.

With Galxe 2.0, insurers can harness the power of artificial intelligence to streamline processes, optimize workflows, and make data-driven decisions. Our state-of-the-art algorithms analyze vast amounts of information in real-time, enabling insurers to provide personalized offers, assess risk with unmatched precision, and enhance customer satisfaction.

Stay ahead of the competition in the rapidly evolving insurance landscape. Partner with Galxe 2.0 and unlock endless possibilities for growth, profitability, and innovation. Join the revolution today!

Introducing Galxe 2.0

Galxe 2.0 is a groundbreaking solution that is set to revolutionize the insurance industry. Powered by AI-driven technology, Galxe 2.0 is designed to bring innovation, efficiency, and convenience to the insurance sector.

Smart and Efficient

With Galxe 2.0, insurance companies can streamline their operations and enhance their decision-making processes. The advanced AI algorithms analyze vast amounts of data in real time, allowing insurers to make accurate predictions and improve risk assessment.

Enhanced Customer Experience

Galxe 2.0 also focuses on improving the customer experience. Its user-friendly interface provides customers with quick access to insurance information, policy details, and claims handling. Moreover, Galxe 2.0 leverages natural language processing to ensure that customers receive prompt and accurate responses to their inquiries.

With Galxe 2.0, insurance companies can:

- Optimize underwriting processes

- Reduce fraud and improve risk management

- Automate claim settlement

- Enhance customer engagement and satisfaction

Discover the future of insurance with Galxe 2.0 – the AI-driven solution that is reshaping the industry.

Revolutionizing Insurance

The insurance industry is facing numerous challenges, from increasing competition to rising customer expectations. Galxe 2.0 is here to revolutionize the insurance industry by providing AI-driven solutions that address these challenges head-on.

With Galxe 2.0, insurance companies can streamline their processes and provide more personalized services to their customers. Our AI algorithms analyze vast amounts of data to identify patterns and make accurate predictions, allowing insurance companies to better assess risks and offer tailored coverage options.

By leveraging the power of AI, Galxe 2.0 is able to automate claims processing and reduce the time it takes for customers to receive their payouts. This not only improves customer satisfaction but also helps insurance companies save time and resources.

Another area where Galxe 2.0 is revolutionizing insurance is fraud detection. Our AI algorithms are constantly learning and adapting, allowing them to detect suspicious patterns and prevent fraudulent claims before they are paid out.

Galxe 2.0 also helps insurance companies improve their underwriting process by providing real-time insights into risk assessment. This allows insurers to make more accurate pricing decisions and offer customized policies that better match their customer’s needs.

With its AI-driven solutions, Galxe 2.0 is transforming the insurance industry, enabling companies to stay ahead of the competition and meet the evolving demands of their customers. Revolutionize your insurance business with Galxe 2.0 today!

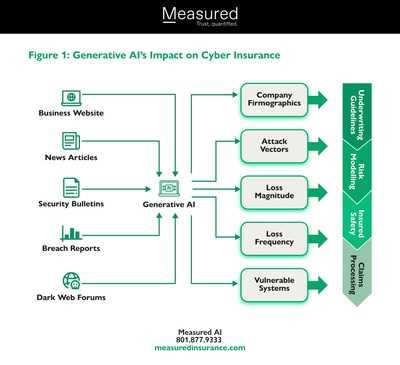

AI-driven Solutions

At Galxe 2.0, we believe in the power of artificial intelligence to revolutionize the insurance industry. Our AI-driven solutions are designed to streamline processes, increase efficiency, and provide valuable insights that enable insurance companies to stay ahead in a rapidly changing market.

With our advanced machine learning algorithms, we can analyze vast amounts of data in real-time, helping insurers make more accurate risk assessments and provide better coverage options to their customers. Our AI-driven solutions also enhance claims management, automating the process and reducing the time it takes to process a claim.

But our solutions go beyond just data analysis. With natural language processing technology, we enable insurance companies to communicate with their customers more effectively. Our chatbot solutions can handle customer inquiries, provide personalized recommendations, and even assist with policy renewal.

Furthermore, our AI-driven solutions provide predictive modeling capabilities, allowing insurers to anticipate future trends and adjust their strategies accordingly. By identifying patterns and predicting potential risks, insurance companies can proactively mitigate losses and improve overall performance.

With Galxe 2.0’s AI-driven solutions, the insurance industry is entering a new era of innovation and efficiency. Contact us today to learn more about how our technology can help your business thrive in the digital age.

Transforming the Industry

Galxe 2.0 is not just another insurance solution, it is a game-changer in the industry. With its innovative AI-driven solutions, it is revolutionizing the way insurance companies operate, transforming the industry as a whole.

Unprecedented Efficiency

By harnessing the power of artificial intelligence, Galxe 2.0 is able to streamline and automate processes that were once time-consuming and labor-intensive. With its advanced algorithms, it can analyze and process vast amounts of data in seconds, allowing insurance companies to make faster and more informed decisions. This unprecedented efficiency not only saves time and resources, but also improves customer satisfaction by providing quicker and more accurate responses to claims and inquiries.

Enhanced Accuracy and Risk Assessment

Galxe 2.0’s AI capabilities enable it to significantly improve the accuracy of risk assessment in the insurance industry. By analyzing historical data, current market trends, and various risk factors, it can provide insurers with more precise risk profiles and insurance quotes. This enhanced accuracy benefits both insurance companies and customers, ensuring fairer premiums and better coverage options.

Increased Personalization

Through its AI-driven solutions, Galxe 2.0 is able to personalize insurance products and services based on individual needs and preferences. By analyzing customer data and behavior patterns, it can offer tailored policy recommendations, customized coverage options, and personalized customer support. This increased personalization not only improves customer satisfaction, but also helps insurance companies attract and retain customers in an increasingly competitive market.

In conclusion, Galxe 2.0 is transforming the insurance industry by introducing AI-driven solutions that enhance efficiency, accuracy, and personalization. With its advanced capabilities, it is revolutionizing the way insurance companies operate, paving the way for a more streamlined, customer-centric future.

Question-answer:

What is Galxe 2.0?

Galxe 2.0 is an AI-driven solution that aims to revolutionize the insurance industry by providing advanced analytics and automation capabilities.

How does Galxe 2.0 work?

Galxe 2.0 uses artificial intelligence algorithms to analyze insurance data and provide insights and predictions. It can automate various processes, such as claims processing, underwriting, and risk assessment.

What are the benefits of using Galxe 2.0?

Using Galxe 2.0 can improve efficiency, accuracy, and profitability in the insurance industry. It can help insurers streamline their operations, reduce costs, and make better-informed decisions.

Can Galxe 2.0 be integrated with existing insurance systems?

Yes, Galxe 2.0 is designed to be easily integrated with existing insurance systems. It can work alongside existing software and data infrastructure to enhance their capabilities.