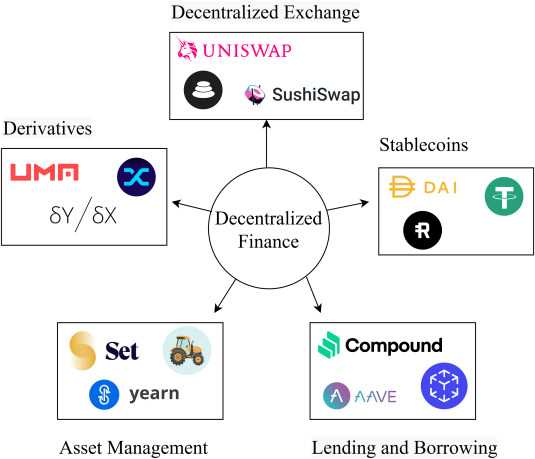

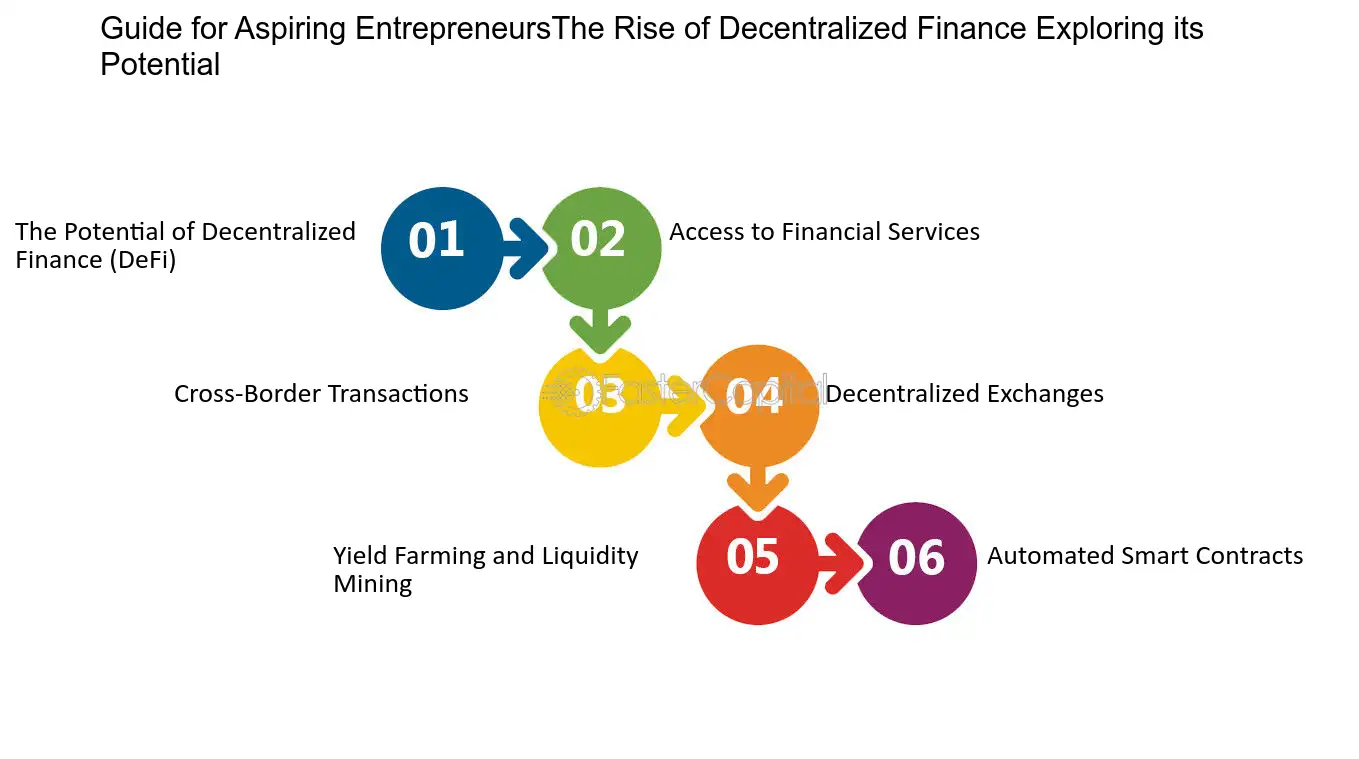

In recent years, decentralization has emerged as a powerful force in the world of finance. One of the most exciting developments in this space is the rise of decentralized finance, or DeFi. DeFi platforms allow users to access financial services such as lending, borrowing, and investing, all without the need for intermediaries like banks or traditional financial institutions.

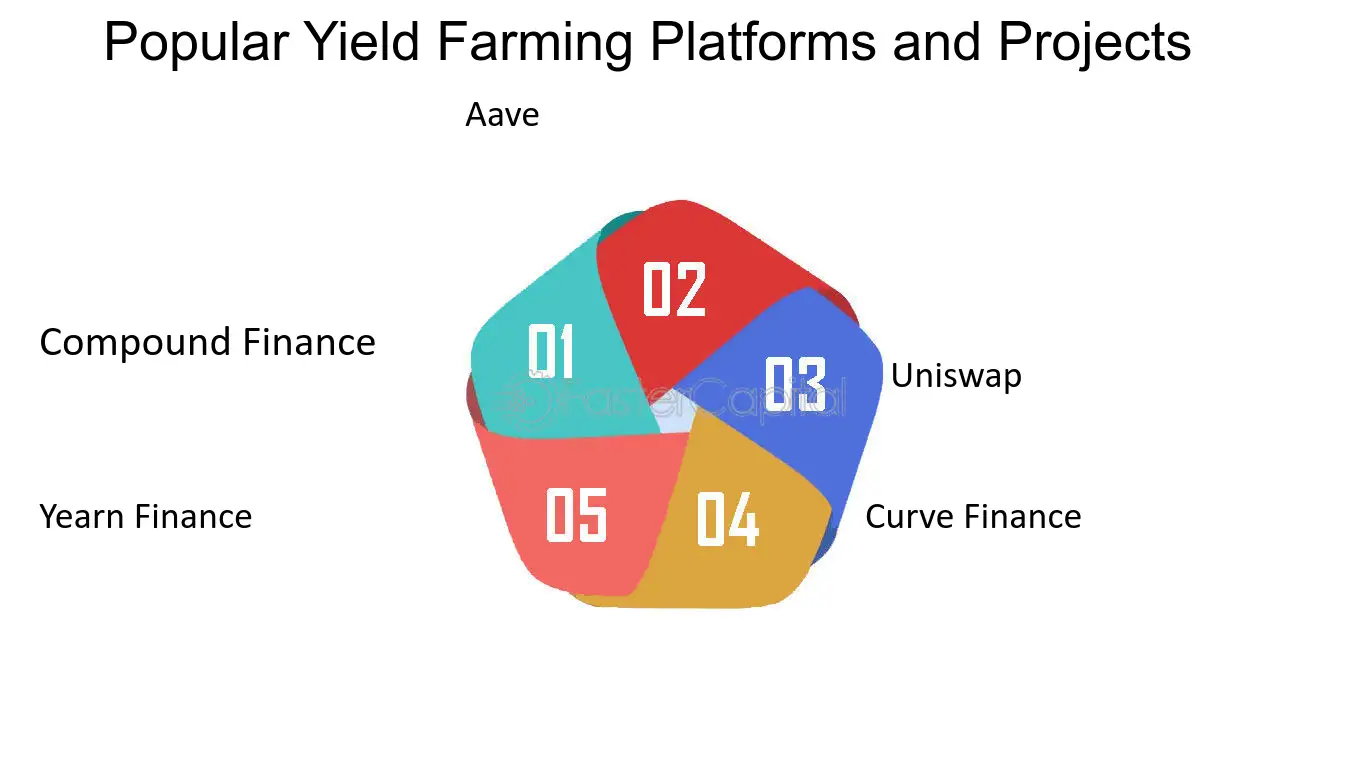

Three of the most prominent DeFi platforms are Aave, Compound, and Yearn.Finance. These platforms have gained significant attention and popularity due to their innovative features and the financial opportunities they offer to users.

Aave is a decentralized lending platform that enables users to deposit their cryptocurrencies and earn interest on their holdings. Users can also borrow assets against their collateral, all in a completely permissionless and non-custodial manner. Aave’s unique feature is its implementation of flash loans, which allow users to borrow assets without any collateral as long as the loan is repaid within a single transaction block.

Compound, on the other hand, is a decentralized borrowing and lending protocol that operates on the Ethereum blockchain. It allows users to lend or borrow various cryptocurrencies by depositing their assets into the platform’s smart contracts. The interest rates for borrowing and lending are determined by the market dynamics of supply and demand, creating a transparent and efficient system.

Lastly, Yearn.Finance is a suite of DeFi products that aims to optimize yield farming strategies. Yield farming involves lending or staking cryptocurrencies in order to earn rewards in the form of additional tokens. Yearn.Finance automatically moves user funds between different DeFi platforms to maximize their returns, making it a popular choice for investors seeking the highest yields.

As DeFi continues to grow and evolve, platforms like Aave, Compound, and Yearn.Finance are at the forefront of innovation and are pushing the boundaries of what is possible in the world of decentralized finance. Whether you are looking to earn interest on your crypto holdings, borrow assets, or maximize your returns through yield farming, these platforms offer a range of options to suit your financial needs.

Understanding DeFi and its Advantages

Decentralized Finance, or DeFi, refers to a system that uses blockchain technology to recreate traditional financial instruments in a decentralized and transparent manner. DeFi aims to democratize financial services by eliminating intermediaries and giving individuals more control over their finances.

The Advantages of DeFi

DeFi offers several advantages over traditional financial systems:

1. Accessibility:

DeFi platforms are open to anyone with an internet connection, allowing individuals from all over the world to access financial services. This is particularly beneficial for the unbanked and underbanked populations who may not have access to traditional banking services.

2. Transparency:

DeFi transactions are recorded on a public blockchain, making them transparent and verifiable. This increases trust in the system and reduces the risk of fraud, as all transactions can be audited by anyone.

3. Security:

DeFi platforms use smart contracts, which are self-executing agreements with the terms of the contract directly written into code. These contracts are executed on the blockchain, eliminating the need for intermediaries and reducing the risk of human error or manipulation.

Challenges and Risks

While DeFi offers many advantages, there are also challenges and risks to consider:

1. Complexity:

DeFi platforms can be complex and require a certain level of technical understanding to use effectively. This can be a barrier for individuals who are not familiar with blockchain technology.

2. Security Vulnerabilities:

Although DeFi platforms aim to be secure, they are not immune to security vulnerabilities. Smart contracts can have bugs or be exploited, leading to potential financial losses. It is important for users to thoroughly review and understand the risks before participating in DeFi platforms.

3. Regulatory Uncertainty:

As DeFi platforms operate outside the traditional financial system, there is regulatory uncertainty surrounding their operations. Different jurisdictions may have different regulations or may choose to regulate DeFi in the future, which could impact the accessibility and viability of these platforms.

Despite these challenges, DeFi has the potential to revolutionize the financial industry by providing accessible, transparent, and secure financial services to individuals worldwide.

Exploring Aave: A Leading DeFi Protocol

Aave is one of the leading decentralized finance (DeFi) protocols in the cryptocurrency ecosystem. It aims to provide users with a wide range of financial services and opportunities, such as borrowing, lending, and earning interest on digital assets. Aave is built on the Ethereum blockchain and is governed by its native token, AAVE.

How Aave Works

Aave operates on the concept of liquidity pools, where users can deposit their assets and earn interest or borrow assets from these pools. These pools are smart contracts that contain a specific asset, such as ETH or stablecoins, and determine the interest rates based on supply and demand dynamics.

One key feature of Aave is its flash loan functionality. Flash loans allow users to borrow funds without any collateral, as long as the loan is repaid within the same transaction. This feature has been a game-changer for developers, enabling them to create innovative applications and interact with other DeFi protocols in a more efficient manner.

Aave’s Governance and Token

Aave’s governance is decentralized, giving token holders the power to control the protocol’s development and decision-making through the Aave Improvement Proposal (AIP) process. Token holders can submit proposals for protocol updates, and voting is conducted using AAVE tokens. This decentralized governance ensures that the community has a say in the evolution of the platform.

The AAVE token is a vital component of Aave’s ecosystem. Holders of AAVE have various benefits, such as voting rights, fee discounts, and the ability to stake their tokens for additional rewards. The token has gained significant traction in the DeFi space, with a growing market cap and widespread usage within the Aave protocol.

The Importance of Aave in DeFi

Aave’s innovative features and robust infrastructure have contributed to its position as a leading DeFi protocol. It provides users with access to decentralized loans and deposit services, allowing them to earn interest on their assets, borrow funds instantly, and participate in the ever-expanding DeFi ecosystem.

Furthermore, Aave’s commitment to security and audited smart contracts has gained the trust of users and investors alike. This has resulted in significant adoption and liquidity on the platform, making it a key player in the DeFi revolution.

Conclusion

Aave stands as one of the pioneering DeFi protocols, revolutionizing the way users interact with cryptocurrencies and decentralized financial services. With its extensive range of features, decentralized governance, and growing community, Aave continues to play a crucial role in shaping the future of finance.

Compound and Yearn.Finance: Unleashing the Power of Yield Farming

Compound and Yearn.Finance are two leading decentralized finance (DeFi) platforms that have revolutionized the world of yield farming. Yield farming, also known as liquidity mining, allows users to earn passive income by providing liquidity to DeFi protocols.

Compound is a lending and borrowing platform that allows users to earn interest on their cryptocurrency holdings or borrow assets by collateralizing their crypto assets. It operates on a system of algorithmically determined interest rates, which incentivize users to lend or borrow based on market demand.

Yearn.Finance, on the other hand, is a yield aggregator that optimizes yield farming strategies by automatically moving funds between different DeFi protocols to maximize returns. It aims to simplify the yield farming process for users by automating the decision-making process and actively seeking out the most profitable opportunities.

Yield farming on Compound and Yearn.Finance involves users depositing their assets into the respective protocols and earning rewards in the form of governance tokens. These tokens can then be staked or sold for a profit. The yield farming ecosystem has grown rapidly, with users flocking to these platforms to take advantage of the lucrative opportunities.

The power of yield farming lies in its ability to generate high returns on investment. By participating in yield farming, users can earn a share of the fees generated by the DeFi platforms and benefit from token price appreciation. However, it’s important to note that yield farming also carries risks, such as smart contract vulnerabilities and impermanent loss.

In conclusion, Compound and Yearn.Finance are at the forefront of the yield farming movement, offering users the opportunity to take advantage of the lucrative returns offered by DeFi. As the DeFi ecosystem continues to evolve, these platforms will play a crucial role in unlocking the full potential of decentralized finance.

Question-answer:

What is DeFi?

DeFi stands for Decentralized Finance, which refers to a category of financial applications built on blockchain technology. These applications aim to provide traditional financial services, such as lending, borrowing, and trading, in a decentralized manner without the need for intermediaries like banks.

What is Aave?

Aave is a decentralized lending protocol on the Ethereum blockchain. It allows users to lend and borrow various cryptocurrencies by depositing collateral into smart contracts. Aave implements unique features like flash loans and uncollateralized borrowing, which sets it apart from other DeFi protocols.

How does Compound work?

Compound is a decentralized lending and borrowing protocol that allows users to earn interest on their deposited assets or borrow assets by providing collateral. The interest rates are determined algorithmically based on the supply and demand for each asset on the platform. Compound is governed by the community through the COMP token.

What is Yearn.Finance?

Yearn.Finance is a decentralized yield farming platform that aims to maximize the returns on users’ cryptocurrency holdings. It uses automation to optimize yield farming strategies across various DeFi protocols, such as Aave, Compound, and Curve Finance. Yearn.Finance’s governance token, YFI, allows the community to vote on protocol upgrades and distributions.