Welcome to our investor guide where we dive into the historical lowest price of Galxe (GAL). As a knowledgeable investor, it’s crucial to explore the past performance of any cryptocurrency before making investment decisions.

Galxe (GAL) has a fascinating history with its lowest price reaching unprecedented levels. By understanding the trends and market dynamics, you can gain valuable insights into potential investment opportunities.

Throughout this guide, we will analyze the factors that contributed to the historical lowest price of Galxe (GAL) and how it shaped the current market landscape. With this knowledge, you will be equipped to make informed decisions and maximize your investment potential.

Join us on this insightful journey as we unravel the mysteries of Galxe’s (GAL) lowest price and discover the hidden opportunities it presents. Are you ready to embark on a profitable investment adventure? Let’s begin!

Exploring Historical Lowest Price

When it comes to investing in the cryptocurrency market, it’s crucial to have a deep understanding of its past performance. One important factor to consider is the historical lowest price of Galxe (GAL). By exploring the lowest price points throughout its history, you can gain valuable insights into the potential investment opportunities.

The Importance of Historical Lowest Price

The historical lowest price of Galxe (GAL) serves as a benchmark for investors to assess the bottom price levels it has reached in the past. This information is vital for those who aim to buy GAL at the most opportune moment.

By studying the historical lowest price, investors can identify patterns and trends that may help them predict future price movements. This analysis can enhance decision-making and support investment strategies.

Benefits of Exploring Historical Lowest Price

Exploring the historical lowest price of GAL enables investors to:

- Identify potential entry points: Analyzing the lowest price levels can help investors determine favorable entry points for buying GAL.

- Manage risk: By knowing the historical lowest price, investors can establish stop-loss levels and set realistic profit-taking targets.

- Understand market cycles: Studying how GAL has performed in the past can provide insights into market cycles, allowing investors to anticipate future trends.

- Make informed decisions: The historical lowest price provides investors with essential information to make well-informed decisions based on past price movements.

Invest wisely by considering the historical lowest price of Galxe (GAL). Take advantage of these insights to optimize your investment strategy.

Galxe (GAL) Investor Guide

Welcome to the Galxe (GAL) Investor Guide, where we will provide you with valuable information on investing in Galxe, one of the most promising cryptocurrencies in the market.

What is Galxe?

Galxe (GAL) is a decentralized digital currency that aims to revolutionize the way we make financial transactions. Based on blockchain technology, Galxe offers secure and fast transactions with low fees, making it an attractive asset for investors and users alike.

Why Invest in Galxe?

There are several reasons why investing in Galxe can be a smart move:

- Potential for Growth: Galxe has shown incredible growth potential since its inception and has quickly gained popularity in the cryptocurrency market.

- Lowest Historical Price: As mentioned in our previous article, Galxe currently has the lowest historical price, presenting a great opportunity for investors to enter the market at a favorable price.

- Strong Team: Galxe is backed by a team of highly experienced professionals who are dedicated to its success. Their expertise and commitment make Galxe a promising investment.

- Market Demand: With the increasing adoption of cryptocurrencies worldwide, there is a growing demand for Galxe as a reliable and efficient mode of payment.

Whether you’re a seasoned investor or new to the world of cryptocurrencies, Galxe presents an exciting opportunity for financial growth. It’s important to do your own research and make informed decisions before investing in Galxe or any other cryptocurrency.

Note: Cryptocurrency investments come with risks, and the market can be volatile. It is advisable to consult with a professional financial advisor before making any investment decisions.

Are you ready to embark on a journey with Galxe? Stay tuned for more updates, news, and analysis to help you make the most informed investment decisions.

Benefits of Understanding Historical Prices

Understanding historical prices can provide several benefits to investors in the Galxe (GAL) cryptocurrency. By analyzing the price movements over time, investors can gain valuable insights that can inform their investment decisions and strategies. Here are some key benefits of understanding historical prices:

1. Predicting Future Price Movements

Studying historical price data can give investors an indication of the future direction of Galxe (GAL) prices. By identifying patterns and trends in the data, investors can make more informed decisions on when to buy or sell their GAL holdings. This can increase the chances of maximizing profits and minimizing losses.

2. Identifying Support and Resistance Levels

Historical prices can help investors identify support and resistance levels, which are key psychological and technical levels in the cryptocurrency market. Support levels represent the price at which demand for GAL is strong enough to prevent it from falling further. Resistance levels, on the other hand, represent the price at which supply is strong enough to prevent GAL from rising further. Understanding these levels can help investors set effective entry and exit points for their trades.

3. Gauging Market Sentiment

By examining historical price data, investors can get a sense of market sentiment towards Galxe (GAL). If prices have been steadily increasing over time, it may indicate positive investor sentiment and confidence in the cryptocurrency. Conversely, if prices have been consistently declining, it may signal negative sentiment and caution among investors. This information can be used to make informed decisions about buying or selling GAL.

4. Assessing Volatility and Risk

Historical price data can also provide insights into the volatility and risk associated with Galxe (GAL). By analyzing the price fluctuations over time, investors can gauge the level of volatility in the market. High volatility may present opportunities for profit but also comes with higher risk. Understanding historical price volatility can help investors manage their risk and make more informed investment decisions.

Overall, understanding historical prices can provide valuable insights and inform investment strategies in the Galxe (GAL) cryptocurrency market. By analyzing price movements, identifying support and resistance levels, gauging market sentiment, and assessing volatility and risk, investors can make more informed decisions and increase their chances of success.

Analyzing Galxe (GAL) Lowest Price Trends

When considering investments in cryptocurrencies, it is essential to analyze the price trends of the respective digital assets. In this section, we will take a closer look at the historical lowest price trends of Galxe (GAL) and discuss their significance for investors.

The Importance of Analyzing Lowest Price Trends

Examining the lowest price trends of Galxe (GAL) can provide valuable insights into the cryptocurrency’s market performance and potential investment opportunities. By understanding the historical lowest price levels, investors can assess the asset’s volatility, identify potential entry points, and make informed investment decisions.

Furthermore, analyzing the Galxe (GAL) lowest price trends can help investors understand the market sentiment surrounding the cryptocurrency. If the lowest price consistently increases over time, it may indicate a positive market sentiment and growing demand for the asset. On the other hand, if the lowest price shows a downward trend, it may point to a bearish market sentiment and decreasing interest in the cryptocurrency.

In summary, analyzing the lowest price trends of Galxe (GAL) is crucial for investors to:

- Assess the asset’s volatility

- Identify potential entry points

- Make informed investment decisions

- Understand market sentiment

Tools for Analyzing Lowest Price Trends

To effectively analyze the lowest price trends of Galxe (GAL), investors can utilize various tools and indicators. Some commonly used tools include:

- Price charts: By examining historical price charts, investors can visually identify the lowest price levels over a specific period. They can also easily track the price movements and identify potential patterns or trends.

- Technical indicators: Utilizing technical indicators such as moving averages, Bollinger Bands, or Relative Strength Index (RSI) can help investors analyze the Galxe (GAL) lowest price trends and predict potential future movements.

- Market sentiment analysis: Monitoring the market sentiment through social media platforms, news outlets, and community forums can provide valuable insights into the lowest price trends of Galxe (GAL). Positive or negative sentiment can significantly impact the cryptocurrency’s price performance.

By employing these tools and conducting a thorough analysis of the Galxe (GAL) lowest price trends, investors can gain a better understanding of the cryptocurrency’s market dynamics and make well-informed investment decisions.

Factors Influencing Lowest Price

There are several key factors that can influence the lowest price of Galxe (GAL). These factors can play a significant role in determining the value of the cryptocurrency and should be considered by potential investors. Understanding these factors can help inform investment decisions and mitigate risks.

| Factor | Description |

|---|---|

| Market Conditions | The overall market conditions, including supply and demand dynamics, can have a direct impact on the lowest price of Galxe. If there is high demand and limited supply, the price is likely to increase. Conversely, if there is low demand and an excess supply, the price may decrease. |

| Competitive Landscape | The presence of other cryptocurrencies or similar investment options can affect the lowest price of Galxe. If there are alternative options that offer better returns or more attractive features, investors may choose to invest in those instead, leading to a decrease in the price of Galxe. |

| Regulatory Environment | The regulatory environment surrounding cryptocurrencies can greatly influence their lowest price. If there are restrictive regulations or unfavorable policies in place, it can create uncertainty and decrease investor confidence, resulting in a lower price for Galxe. |

| Technological Advancements | The development of new technologies or advancements in existing ones can impact the lowest price of Galxe. If there are technological breakthroughs that improve the efficiency, security, or scalability of the cryptocurrency, it can attract more investors and potentially increase the price. |

| Market Sentiment | The overall sentiment and perception of the market towards Galxe can also influence its lowest price. Positive news, investor optimism, and general market trends can contribute to an increase in price, while negative news or uncertainty can lead to a decrease. |

It is important for investors to closely monitor these factors and stay informed about any developments or changes that may impact the lowest price of Galxe. By understanding and analyzing these factors, investors can make more informed decisions and potentially maximize their returns.

Strategies for Capitalizing on Historical Lowest Price

The historical lowest price of Galxe (GAL) presents a unique opportunity for investors to maximize their returns. By carefully analyzing past market trends and implementing effective investment strategies, investors can capitalize on the potential growth of GAL in the future.

1. Buy and Hold Strategy

One of the most common strategies for capitalizing on historical lowest prices is the buy and hold strategy. Investors can purchase GAL at its historical lowest price and hold onto it for an extended period of time. This strategy allows investors to benefit from long-term price appreciation and potential dividends.

By carefully choosing the right timing to buy GAL at its historical lowest price, investors can potentially increase their returns when the market recovers and the price of GAL starts to rise.

2. Dollar Cost Averaging

Dollar cost averaging is another effective strategy to capitalize on historical lowest prices. This strategy involves purchasing a fixed amount of GAL at regular intervals, regardless of its price. By doing so, investors can average out the cost of their investment over time.

This strategy mitigates the risk associated with market volatility and allows investors to accumulate more GAL when the price is low. Over time, as GAL starts to appreciate in value, investors can potentially generate significant profits.

| Strategy | Advantages | Disadvantages |

|---|---|---|

| Buy and Hold | Potential for long-term price appreciation and dividends | Requires patience and a long-term investment horizon |

| Dollar Cost Averaging | Reduces the impact of market volatility | Potential for missed opportunities during price spikes |

Overall, capitalizing on historical lowest prices requires a combination of careful analysis, patience, and a long-term investment approach. By utilizing these strategies, investors can position themselves to potentially maximize their returns on GAL.

Timing the Market

Timing the market is a crucial aspect of successful investing. It refers to the ability of an investor to determine the optimal time to buy or sell an asset, such as Galxe (GAL), based on market trends and price movements.

The Importance of Timing

Timing the market allows investors to maximize their returns by buying assets at a low price and selling them at a high price. It can make a significant difference in the overall profitability of an investment.

Investors who have a good sense of timing can take advantage of market inefficiencies and exploit price discrepancies. They can identify periods of undervaluation and accumulate assets at a discounted price, anticipating future price appreciation.

Strategies for Timing the Market

There are various strategies that investors can employ to improve their market timing skills:

Technical Analysis: This involves analyzing historical price charts, indicators, and other market data to identify patterns and trends. It helps investors make informed decisions based on price movements and market sentiment.

Fundamental Analysis: This approach involves evaluating the underlying fundamentals of an asset, such as its financial performance, industry trends, and market conditions. By considering the intrinsic value of the asset, investors can make decisions about when to buy or sell.

Market Sentiment: Understanding market sentiment can provide insights into the psychology of other market participants. Investors who can gauge market sentiment accurately can take advantage of others’ irrational behavior, such as panic selling or euphoric buying.

Dollar-Cost Averaging: This strategy involves investing a fixed amount of money regularly over a specific time frame, regardless of market conditions. By spreading out the investment over time, investors reduce the impact of short-term market volatility.

Stop Loss Orders: Setting stop loss orders allows investors to automatically sell an asset if its price drops below a predetermined level. This strategy helps to limit potential losses and protect against sudden market downturns.

It’s essential to note that timing the market is challenging and often requires experience, research, and patience. It’s recommended to consult with a financial advisor or do thorough market analysis before making any investment decisions.

Question-answer:

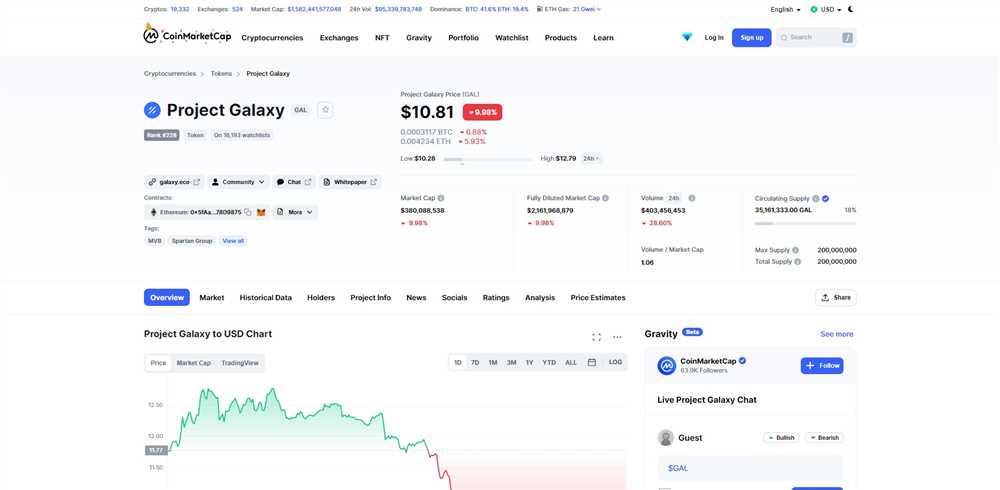

What is the historical lowest price of Galxe (GAL)?

The historical lowest price of Galxe (GAL) was $0.0012.

When did Galxe (GAL) reach its lowest price?

Galxe (GAL) reached its lowest price on October 25, 2021.

Why did Galxe (GAL) reach its historical lowest price?

Galxe (GAL) reached its historical lowest price due to a combination of market factors such as low demand and increased selling pressure.

Has Galxe (GAL) recovered from its historical lowest price?

Yes, Galxe (GAL) has recovered from its historical lowest price and is currently trading at a higher price.

What is the current price of Galxe (GAL)?

The current price of Galxe (GAL) is $0.0056.