Investing in Galxe (GAL) can be a highly lucrative opportunity for investors looking to diversify their portfolios. Galxe is a promising cryptocurrency that is gaining popularity in the market due to its unique features and potential for exponential growth. However, like any investment, it is important to carefully consider the pros and cons before making a decision.

One of the major advantages of investing in Galxe is its potential for high returns on investment. As the popularity of cryptocurrencies continues to rise, Galxe has the potential to experience significant price appreciation, leading to substantial profits for investors. Additionally, Galxe’s technology is based on blockchain, which offers enhanced security and transparency, making it an attractive investment for those concerned about data privacy and security.

Another advantage of investing in Galxe is the opportunity to support innovation and technological advancements. Galxe aims to revolutionize the way we transact and store value, with its decentralized network and innovative features. By investing in Galxe, you are supporting this vision and contributing to the development of cutting-edge technology.

However, it is important to consider the risks associated with investing in Galxe. Cryptocurrencies are known for their volatility, and Galxe is no exception. The price of Galxe can fluctuate greatly in a short period of time, which can lead to significant losses for investors. Additionally, the regulatory environment surrounding cryptocurrencies is still uncertain in many countries, which can add to the investment risk.

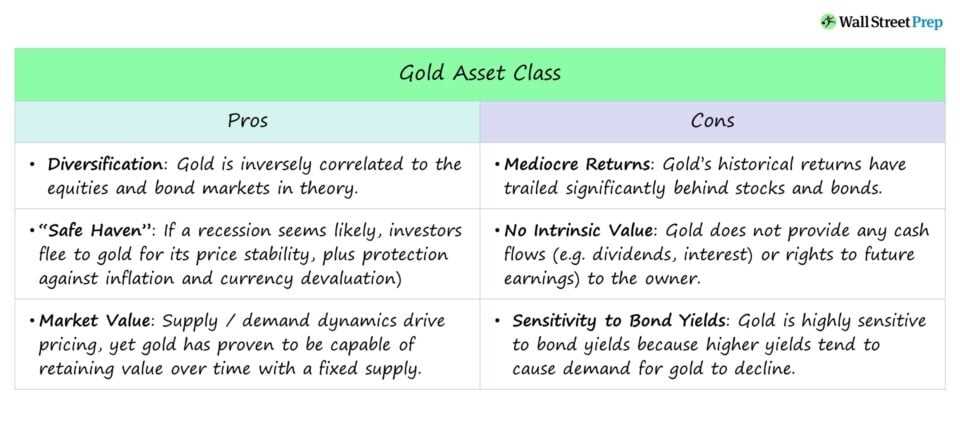

In conclusion, investing in Galxe has its pros and cons. While it offers the potential for high returns and supports technological innovation, it is not without risks. It is important for investors to carefully consider their risk tolerance and do thorough research before making an investment decision. As with any investment, diversification and a long-term investment strategy can help mitigate some of the risks associated with investing in Galxe.

Pros of Investing in Galxe (GAL)

Investing in Galxe (GAL) comes with several potential advantages that can make it an attractive option for investors. Here are some of the key pros to consider:

| 1. Innovative Technology | The Galxe platform utilizes cutting-edge technology, including blockchain, artificial intelligence, and machine learning. This innovative approach can give the project a competitive edge in the market and potentially lead to significant growth. |

| 2. Strong Team | Galxe is backed by a team of experienced professionals with a proven track record in the industry. The team’s expertise and knowledge can inspire confidence in investors and increase the chances of success. |

| 3. Scalability | The Galxe platform has been designed with scalability in mind. This means that as the project grows, it can handle an increasing number of users and transactions without compromising on performance. Scalability is an essential factor for long-term success in the crypto space. |

| 4. Multiple Use Cases | Galxe has identified and developed multiple use cases for its platform, including decentralized finance (DeFi), supply chain management, and digital identity solutions. This diversification of applications can help mitigate risks and maximize potential returns. |

| 5. Transparency and Security | The Galxe platform prioritizes transparency and security, ensuring that user data and assets are protected. By implementing robust security measures and maintaining open communication with its community, Galxe aims to build trust and foster a secure environment for investors. |

| 6. Growing Market | The cryptocurrency market continues to expand, presenting ample opportunities for growth. By investing in Galxe, investors can potentially capitalize on this trend and benefit from the increasing adoption of blockchain technology. |

While these potential pros highlight the benefits of investing in Galxe (GAL), it’s important to conduct thorough research and consider the associated risks before making any investment decisions.

Cons of Investing in Galxe (GAL)

While there are several potential advantages to investing in Galxe (GAL), it is important to also consider the potential downsides. Here are some of the cons of investing in Galxe:

1. High volatility

As with any investment in the cryptocurrency market, Galxe (GAL) is subject to high levels of volatility. The value of GAL can experience significant fluctuations in a short period of time, which can lead to potential losses for investors.

2. Regulatory uncertainty

The regulatory environment surrounding cryptocurrencies is still evolving, and it is uncertain how governments and regulatory bodies will ultimately treat and regulate Galxe (GAL) and other cryptocurrencies. Regulatory changes or crackdowns could have a negative impact on the value and usability of GAL.

3. Limited adoption

Galxe (GAL) is a relatively new cryptocurrency, and it has yet to achieve widespread adoption and recognition. The limited number of platforms that accept GAL as a form of payment means that its use and value may be limited compared to more established cryptocurrencies like Bitcoin or Ethereum.

4. Security risks

Investing in Galxe (GAL) and other cryptocurrencies carries inherent security risks. Hacking and theft are common in the cryptocurrency space, and investors must take precautions to protect their GAL holdings. Without proper security measures, investors risk losing their investment.

5. Lack of transparency

Due to the decentralized nature of cryptocurrencies, it can be difficult to obtain accurate and transparent information about Galxe (GAL) and its underlying technology. This lack of transparency may make it harder for investors to fully understand and evaluate the risks and potential of the investment.

It is crucial for investors to carefully consider these potential cons and to conduct thorough research before making any investment decisions regarding Galxe (GAL) or any other cryptocurrency.

Analyzing the Market Trends of Galxe (GAL)

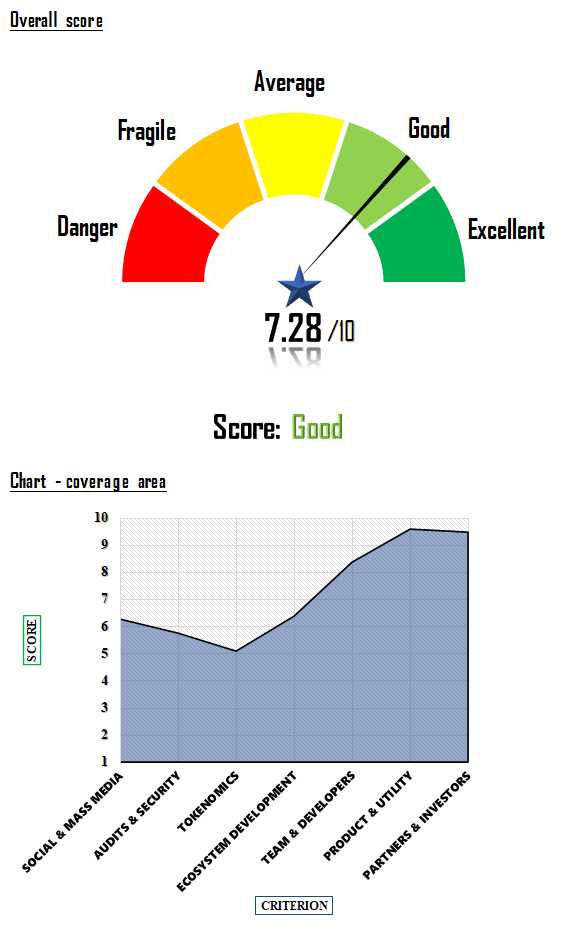

The market trends of Galxe (GAL) provide valuable insights into the potential investment opportunities in this cryptocurrency. By analyzing these trends, investors can make informed decisions about whether to invest in GAL or not.

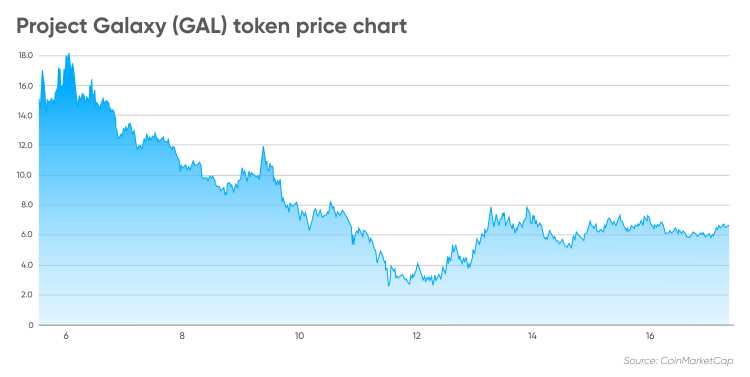

1. Historical Price Performance

Examining the historical price performance of GAL can reveal patterns and trends that may help predict future price movements. Investors can look at price charts, analyze price fluctuations, and identify key support and resistance levels. This historical analysis can provide an understanding of GAL’s price volatility and its potential for growth.

2. Market Capitalization

Market capitalization is an important metric for assessing the popularity and adoption of a cryptocurrency like GAL. By tracking GAL’s market capitalization over time, investors can gauge the level of interest and investment in GAL. Higher market capitalization indicates a larger investor base and potentially greater liquidity and market stability.

Furthermore, comparing GAL’s market capitalization to other cryptocurrencies in the market can help investors assess its competitiveness and potential for growth.

3. Trading Volume

Trading volume reflects the level of activity and liquidity in the GAL market. Higher trading volumes indicate greater investor interest and participation. Analyzing GAL’s trading volume can help investors understand market sentiment, identify trends, and anticipate price movements.

Additionally, monitoring the order book and analyzing the buying and selling pressure can provide insights into the overall market dynamics and potential price shifts.

Overall, analyzing the market trends of GAL is crucial for investors considering investing in this cryptocurrency. By examining historical price performance, market capitalization, and trading volume, investors can gain valuable insights to make informed investment decisions.

Considerations for Investing in Galxe (GAL)

As with any investment, there are several factors that investors should consider before investing in Galxe (GAL). These considerations can help to assess the potential risks and rewards associated with the investment. Here are some key factors to keep in mind:

1. Volatility

Galxe (GAL) is known for its volatility, which can result in significant price fluctuations. While this volatility can present opportunities for high returns, it also comes with increased risk. Investors should be prepared for the possibility of large swings in the market price of GAL and consider their risk tolerance before investing.

2. Market Demand

Investors should evaluate the current and potential future market demand for Galxe (GAL) before making any investment decisions. This includes considering the technology’s adoption rate, competition in the market, and any potential regulatory or legal issues that could affect the demand for GAL.

3. Project Team

The strength and experience of the project team behind Galxe (GAL) should also be assessed. A strong team with a proven track record can increase the chances of project success and may be more likely to attract investor interest. Investors should research the team’s background, previous projects, and any relevant experience in the blockchain and cryptocurrency space.

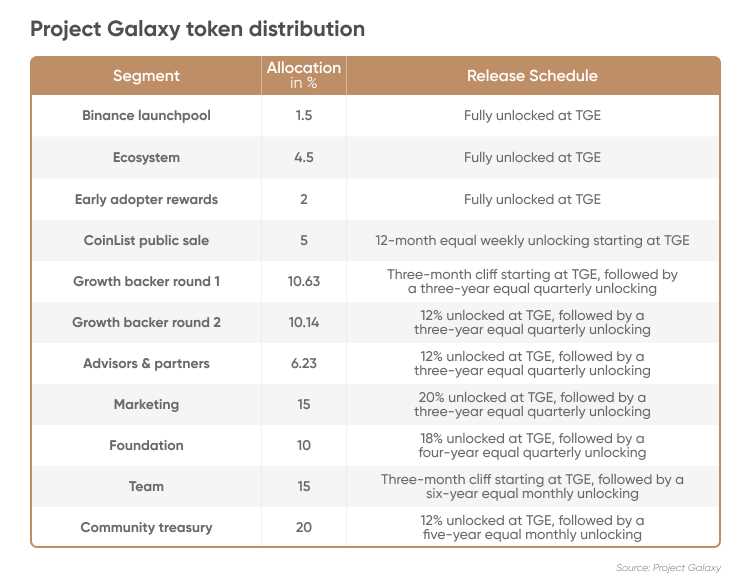

4. Partnerships and Collaborations

Partnerships and collaborations can play a significant role in the success of Galxe (GAL). Investors should investigate the project’s current and potential future partnerships with other companies or organizations. These partnerships can provide valuable resources, expertise, and market access that can contribute to the growth and adoption of GAL.

5. Project Roadmap

Investors should carefully review Galxe’s (GAL) project roadmap, which outlines the timeline and milestones for the development and implementation of the technology. A clear and well-defined roadmap can demonstrate the project’s commitment to achieving its goals and provide investors with confidence in the project’s long-term viability.

| Pros | Cons |

|---|---|

| High potential for returns | Volatility can lead to significant losses |

| Market demand for blockchain technology | Uncertainty in the regulatory environment |

| Strong project team with relevant experience | Competition in the market |

| Partnerships with established companies | Technological risks and challenges |

| Clear and well-defined project roadmap | Limited track record and history |

By carefully considering these factors, investors can make more informed decisions when it comes to investing in Galxe (GAL). It is important to conduct thorough research and due diligence before making any investment decisions.

Question-answer:

What is Galxe (GAL) and how does it work?

Galxe (GAL) is a cryptocurrency that operates on the Ethereum blockchain. It is designed to serve as a decentralized finance (DeFi) platform that aims to provide users with trading, lending, and yield farming services. GAL token holders can participate in governance and decision-making processes on the platform. Additionally, GAL offers staking rewards for users who lock up their tokens.

What are the benefits of investing in Galxe?

There are several benefits to investing in Galxe (GAL). Firstly, as a decentralized finance platform, it offers users the opportunity to engage in trading, lending, and yield farming activities. This can potentially generate significant returns on investment. Secondly, GAL token holders have the right to participate in the governance and decision-making processes of the platform, giving them a voice in its future development. Finally, Galxe offers staking rewards, providing an additional way for investors to earn passive income.