The Galaxy is a popular cryptocurrency that has been attracting the attention of investors and traders due to its potential for high returns. As with any investment, the key to success is understanding the factors that can affect its price forecast.

One important factor to consider when analyzing the Galaxy price forecast is market demand. The price of Galaxy can be influenced by the level of demand from buyers. If there is a high demand for Galaxy, the price is likely to increase, while a low demand can lead to a decrease in price.

Another factor that can affect the Galaxy price forecast is market sentiment. The sentiment of investors and traders towards Galaxy can have a significant impact on its price. Positive sentiment, such as news about partnerships or technological advancements, can drive the price up, while negative sentiment, such as regulatory concerns or security breaches, can cause the price to decline.

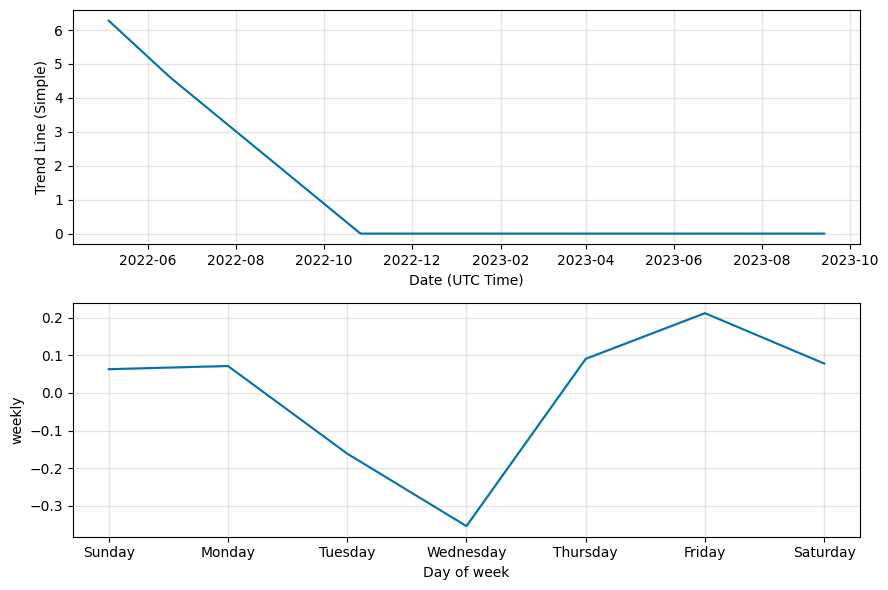

Technical analysis is also crucial when forecasting the Galaxy price for the upcoming week. Traders often use various indicators, such as moving averages or support and resistance levels, to identify patterns and trends in the price history. By analyzing these technical indicators, traders can make informed predictions about future price movements.

Lastly, external factors such as macroeconomic events and regulatory changes can have a substantial impact on the Galaxy price forecast. For example, if there is a new regulation that restricts cryptocurrency trading, it can lead to a decrease in demand and, subsequently, a decrease in price. Similarly, positive news about the wider adoption of cryptocurrencies or economic stability can boost the price of Galaxy.

In summary, analyzing factors such as market demand, market sentiment, technical analysis, and external factors is essential to make an accurate Galaxy price forecast for the upcoming week. By considering these factors and staying informed about the latest developments in the cryptocurrency market, investors and traders can make more informed decisions and increase their chances of success.

Economic Indicators

As part of analyzing factors affecting the Galxe price forecast for the upcoming week, it is important to closely monitor and analyze various economic indicators. These indicators can provide valuable insight into the overall health and performance of the economy, as well as potential factors that may impact the price of Galxe.

Gross Domestic Product (GDP)

GDP is one of the most important economic indicators, as it measures the total value of goods and services produced within a country’s borders over a specific period of time. Changes in GDP can indicate shifts in economic growth, which can have a direct impact on the price of Galxe. For example, if GDP growth is strong, it may indicate increased consumer spending and demand for Galxe, which could drive up its price.

Unemployment Rate

The unemployment rate is another key economic indicator that can influence the price of Galxe. A high unemployment rate may indicate a weaker labor market and lower consumer purchasing power, which could lead to decreased demand for Galxe and a potential decrease in its price. Conversely, a low unemployment rate may suggest a stronger economy and higher consumer spending, which could drive up the price of Galxe.

In addition to GDP and the unemployment rate, other important economic indicators to consider when forecasting the Galxe price include inflation rates, interest rates, consumer sentiment, and government policies. By analyzing these indicators and their potential impact on the economy and consumer behavior, it is possible to make more informed predictions about the future price trends of Galxe.

Market Sentiment and Investor Behavior

When analyzing factors that affect the price forecast for Galxe in the upcoming week, it is important to consider market sentiment and investor behavior. Market sentiment refers to the overall outlook and attitudes of investors towards a particular asset or market. It can be influenced by a variety of factors, including economic indicators, news events, and investor psychology.

Investor behavior is closely linked to market sentiment and refers to the actions and decisions made by investors based on their emotions, beliefs, and expectations. Understanding investor behavior is crucial when predicting price movements as it provides insights into how investors are likely to react to different situations and events.

One factor that can influence market sentiment is the overall economic environment. Positive economic data such as GDP growth, low unemployment rates, and high consumer confidence can create a positive market sentiment and lead to increased investor confidence. On the other hand, negative economic data or geopolitical events can create a negative market sentiment and lead to increased investor caution and risk aversion.

News events can also have a significant impact on market sentiment. Positive news such as company earnings reports, product launches, or regulatory developments can boost investor confidence and lead to increased buying activity. Conversely, negative news such as lawsuits, scandals, or economic downturns can create a negative sentiment and lead to selling pressure.

Investor psychology plays a crucial role in determining market sentiment and behavior. Emotions such as fear, greed, and optimism can heavily influence decision-making and lead to herd behavior, where investors react based on the actions of others rather than their own analysis. Understanding these emotions and their impact on investor behavior can help in predicting price movements and market trends.

Traders and analysts often use technical analysis and sentiment indicators to gauge market sentiment and investor behavior. These tools can provide insights into crowd psychology, market trends, and potential turning points. By analyzing historical price patterns, volume data, and sentiment indicators, traders can identify potential support and resistance levels, as well as key psychological levels that may affect investor behavior.

In conclusion, market sentiment and investor behavior are important factors to consider when analyzing the price forecast for Galxe in the upcoming week. By understanding these factors and their potential impact, traders and investors can make more informed decisions and better navigate the dynamic nature of the market.

Supply and Demand Dynamics

Understanding the supply and demand dynamics is crucial when analyzing factors that affect the price forecast for Galxe in the upcoming week. The interaction between supply and demand plays a significant role in determining the equilibrium price of any asset, including Galxe.

Supply refers to the quantity of Galxe available in the market. It is influenced by several factors, including the production and mining of Galxe, the storage and inventory levels, and any regulatory restrictions or changes in Galxe supply. Higher supply usually leads to lower prices, as there is more Galxe available for purchase.

On the other hand, demand represents the quantity of Galxe that buyers are willing to purchase at different price levels. Demand is influenced by various factors, such as market sentiment, economic indicators, industrial usage of Galxe, and speculation. Higher demand usually leads to higher prices, as buyers are willing to pay more to acquire Galxe.

When analyzing Galxe price forecasts, it is essential to consider the balance between supply and demand. If the supply of Galxe exceeds the demand, prices may decline. Conversely, if demand outweighs supply, prices may rise.

Additionally, it is important to monitor any changes in supply and demand factors that may impact the Galxe market. For example, if there is a sudden increase in Galxe production or a decrease in demand from key industries, it could lead to a decrease in prices. Conversely, if there are supply disruptions or an increase in demand from new applications, prices may increase.

By understanding the supply and demand dynamics and monitoring relevant factors, analysts can make more accurate Galxe price forecasts for the upcoming week. This knowledge can guide investors and traders in making informed decisions and managing their risks.

Regulatory Changes and Legal Landscape

The regulatory landscape plays a crucial role in the price forecast of Galxe. Any changes in regulations can significantly impact the demand and supply dynamics of Galxe, thereby affecting its price. As such, it is important for investors and traders to stay informed about the regulatory changes in the cryptocurrency space.

One recent regulatory change that has had a significant impact on Galxe is the crackdown on unregulated exchanges by governments around the world. Many countries have started implementing stricter rules and regulations for cryptocurrency exchanges to prevent money laundering and illicit activities. These regulatory actions have led to a decrease in trading volume and liquidity in the cryptocurrency market, which in turn has put downward pressure on the price of Galxe.

Additionally, the legal landscape surrounding cryptocurrencies is constantly evolving. Governments are trying to understand and regulate the use of cryptocurrencies within their jurisdictions. Some countries have embraced cryptocurrencies and have implemented supportive regulations, while others have taken a more cautious approach or even banned their use altogether.

Investors and traders need to closely monitor the legal developments in the countries where Galxe is traded. Any changes in the legal framework can affect the market sentiment and, consequently, the price of Galxe.

Impact on Galxe Price Forecast

The regulatory changes and legal landscape can have both positive and negative impacts on the Galxe price forecast for the upcoming week.

Positive impacts may include the implementation of supportive regulations or a favorable legal ruling on the use of cryptocurrencies. These developments can increase investor confidence and attract more participants to the Galxe market, potentially leading to an increase in demand and price.

On the other hand, negative impacts may arise from stricter regulations or bans on cryptocurrencies. These actions can create uncertainty and panic among investors, leading to a decrease in demand and a subsequent decrease in price.

It is important for analysts and traders to stay updated with the latest regulatory and legal developments to make informed decisions regarding Galxe price forecasts.

Table: Countries and their Regulatory Stance on Galxe

| Country | Regulatory Stance |

|---|---|

| United States | Regulated with stringent requirements |

| Japan | Supportive regulations in place |

| China | Banned the use of cryptocurrencies |

| Germany | Regulated with favorable legal environment |

| South Korea | Relaxed regulations |

Technological Advancements and Innovations

Technological advancements and innovations play a crucial role in the galxe market and can significantly impact its forecast for the upcoming week. As technology continues to evolve, new mining techniques and extraction methods are being developed, which can affect the supply and availability of galxe.

One of the key technological advancements in the galxe market is the introduction of advanced data analysis and machine learning algorithms. These tools help analysts and traders to analyze a vast amount of market data and identify patterns and trends. By leveraging these technologies, they can make more accurate price forecasts and better investment decisions.

Another significant innovation in the galxe market is the implementation of blockchain technology. Blockchain provides a transparent and secure platform for recording galxe transactions, creating a decentralized system that eliminates the need for intermediaries. This technology enhances trust and efficiency in the market, which can have a positive impact on price forecasts.

Furthermore, advancements in galxe extraction techniques are also worth noting. Researchers are constantly exploring new methods to extract galxe more efficiently and sustainably. This could increase the overall supply and potentially impact the price forecast for the upcoming week.

Additionally, technological advancements in the transportation and logistics sector can impact galxe price forecasts. Improvements in shipping and delivery methods can reduce costs and increase the availability of galxe, thereby affecting market dynamics and price predictions.

In conclusion, technological advancements and innovations have a significant influence on the galxe market. From data analysis algorithms to the implementation of blockchain technology and improved extraction techniques, these advancements can impact supply, demand, and market dynamics. By staying informed about the latest technological developments, analysts and traders can make more accurate price forecasts for the upcoming week.

Question-answer:

What are some factors that can affect the price forecast of Galxe for the upcoming week?

There are several factors that can affect the price forecast of Galxe for the upcoming week. These include market demand and supply, global economic trends, geopolitical events, regulatory changes, and investor sentiment.

How does market demand and supply impact the price forecast of Galxe?

Market demand and supply play a significant role in determining the price forecast of Galxe. If there is high demand for the cryptocurrency and limited supply, it will drive the price up. Conversely, if there is low demand and a high supply, the price may decrease.

Can global economic trends impact the price forecast of Galxe?

Yes, global economic trends can have a significant impact on the price forecast of Galxe. Factors such as interest rates, inflation, GDP growth, and overall market conditions can influence investor confidence and affect the demand for cryptocurrencies like Galxe.

What are some geopolitical events that can affect the price forecast of Galxe?

Geopolitical events such as political instability, trade wars, or international conflicts can impact the price forecast of Galxe. These events can cause uncertainty in the market and may lead investors to move towards safe-haven assets, which can affect the demand and price of cryptocurrencies.