Get in on the action now! The 1inch Investment Fund has made a move that has the crypto world buzzing. In a daring move, they have decided to sell a staggering 416,924 $UNI tokens. But why would they make such a move? And what does it mean for you?

It’s no secret that the 1inch Investment Fund has always been at the forefront of the cryptocurrency market. With their deep expertise and relentless drive for success, they have consistently made smart investment decisions that have yielded massive returns.

However, this recent move has raised a few eyebrows. Selling such a large number of $UNI tokens can be seen as risky. But the 1inch Investment Fund has always been known to take calculated risks, and this could potentially pave the way for even greater opportunities.

So, what’s in it for you?

By staying ahead of the crowd and investing in the 1inch Investment Fund, you gain access to a world of potential. With their track record of success, you can be confident that they are making strategic moves that have the potential to generate significant returns.

Don’t miss out on this opportunity to be a part of the 1inch Investment Fund’s journey. Join now and become part of a team that is shaping the future of cryptocurrency investing.

1inch Investment Fund Sells $UNI Tokens

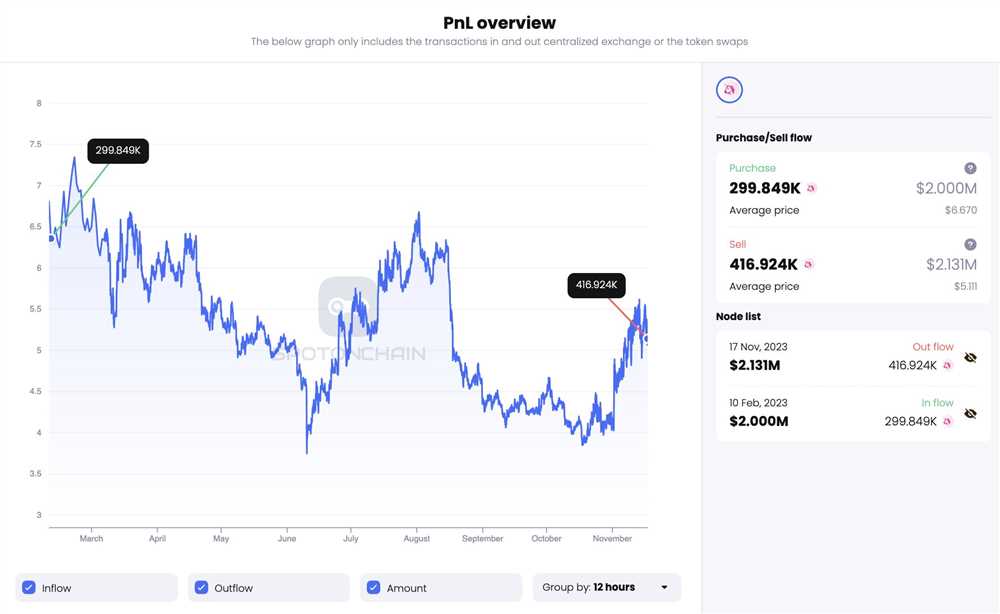

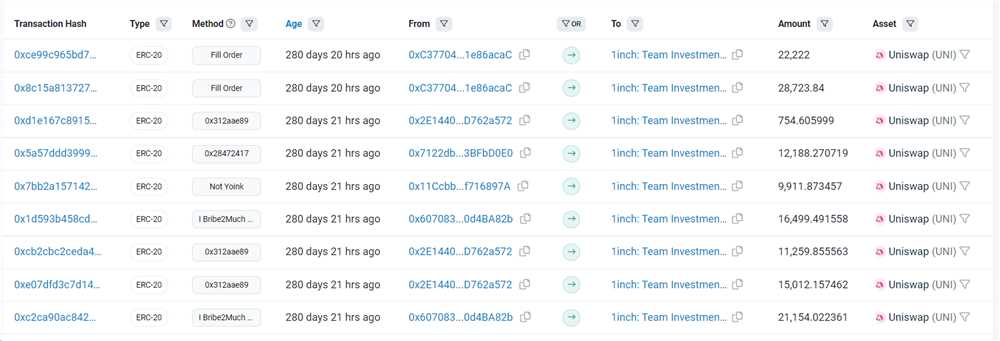

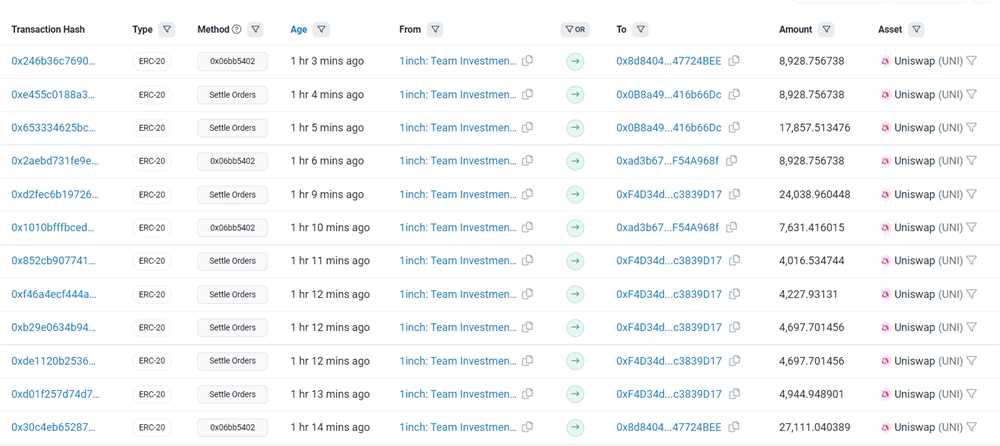

The 1inch Investment Fund recently made the decision to sell 416,924 $UNI tokens, potentially resulting in a loss. This move has attracted significant attention in the cryptocurrency market, as it highlights the fund’s willingness to adapt its portfolio in response to market conditions.

Market Analysis

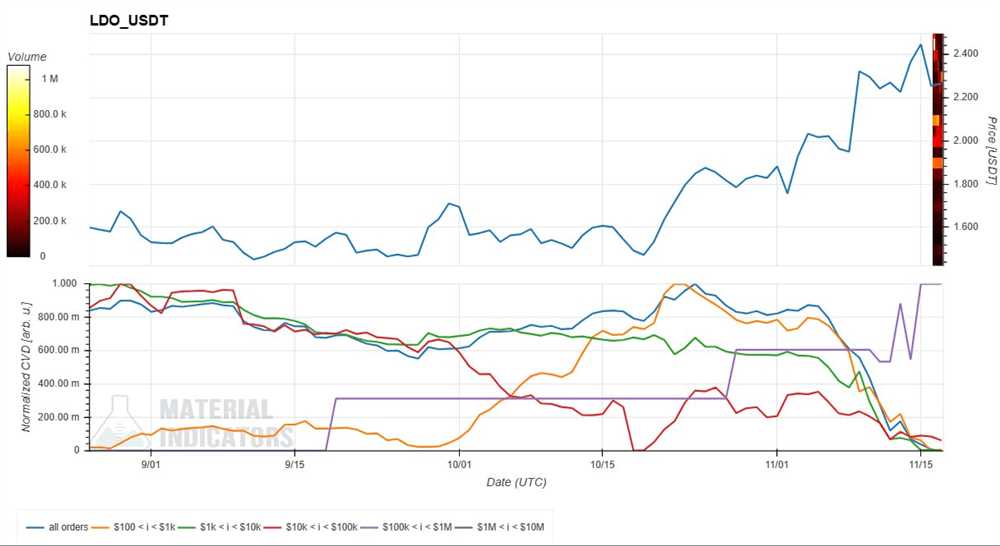

The decision to sell the $UNI tokens came after a thorough market analysis conducted by the 1inch Investment Fund. The fund closely monitored the price fluctuations and overall performance of $UNI tokens in the market before reaching the decision to offload a portion of its holdings.

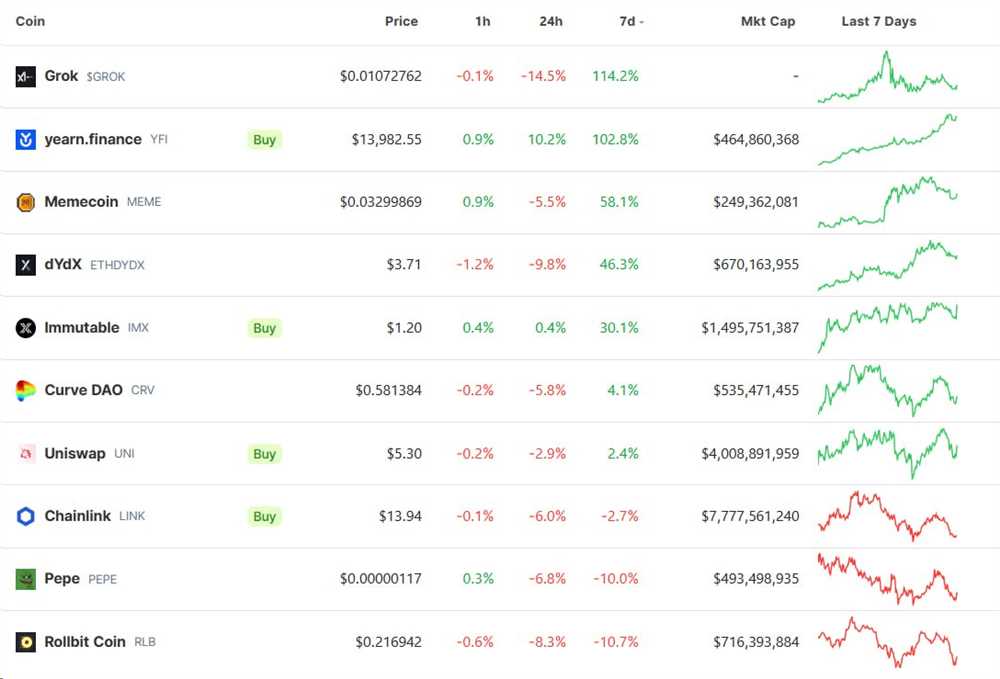

The market analysis revealed a variety of factors that influenced the fund’s decision. These included the overall trend in the decentralized finance (DeFi) sector, the performance of other similar tokens, and the fund’s investment strategy to optimize portfolio returns.

Potential Implications

While the sale of $UNI tokens can potentially result in a loss for the 1inch Investment Fund, it also presents an opportunity for the fund to reallocate its assets and potentially generate greater returns in the future. By constantly reassessing its portfolio and making strategic investment decisions, the fund aims to maximize profitability and minimize risk.

Moreover, the sale of $UNI tokens allows the 1inch Investment Fund to maintain a diversified portfolio and seize new investment opportunities as they arise. The fund remains open to exploring other promising tokens and investment avenues to further expand its holdings.

Market Response

The market response to the sale of $UNI tokens by the 1inch Investment Fund has been mixed. Some investors have expressed concern over the potential loss incurred, while others view it as a smart move to adapt to changing market conditions.

Regardless of the market response, the 1inch Investment Fund’s decision to sell $UNI tokens underscores its commitment to active portfolio management and its objective to continuously optimize investment performance.

Overview:

The 1inch Investment Fund has recently made a decision to sell 416,924 $UNI tokens, potentially resulting in a financial loss. The fund, known for its strategic investments in various cryptocurrencies, has assessed the market conditions and made a calculated move to liquidate a portion of its $UNI holdings.

This decision comes at a time when the cryptocurrency market is experiencing fluctuations and volatility. The 1inch Investment Fund, being a prudent and forward-thinking entity, aims to mitigate potential risks by actively managing its portfolio. By strategically selling $UNI tokens, the fund is taking proactive steps to protect its overall investment and adapt to market dynamics.

The Reasoning:

As with any investment, timing is crucial. After careful analysis of market trends and in-depth research, the 1inch Investment Fund has identified a potential downturn in the value of $UNI tokens. By swiftly liquidating a portion of its holdings, the fund aims to minimize its exposure to potential further losses.

In addition, the fund is constantly evaluating and reassessing its investment strategies to meet its long-term objectives. By actively managing its portfolio, the 1inch Investment Fund remains agile and adaptable in an ever-changing market landscape.

Sale of 416,924 $UNI Tokens

We are excited to announce the sale of 416,924 $UNI tokens by the 1inch Investment Fund. This sale presents an opportunity for cryptocurrency investors to diversify their holdings and potentially generate profits.

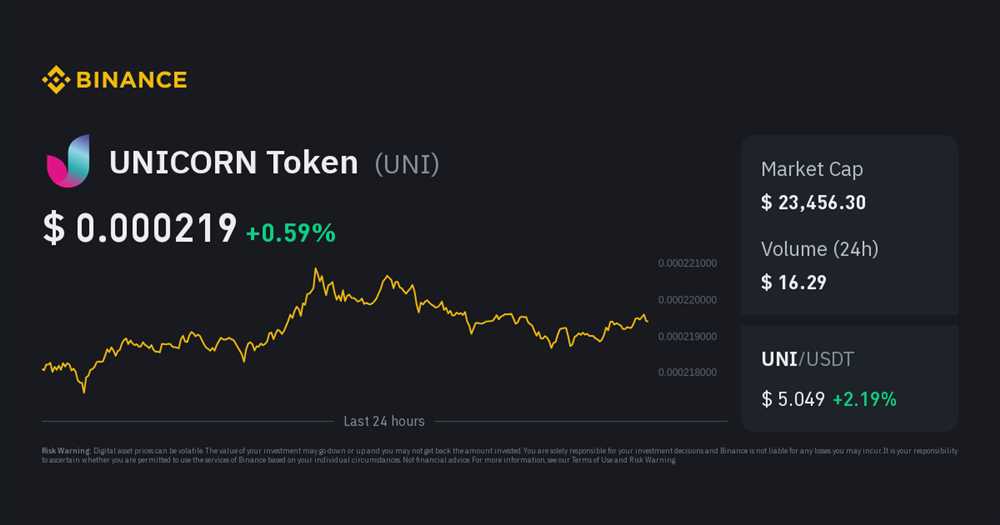

About $UNI Tokens

$UNI tokens are the native cryptocurrency of the Uniswap platform, a decentralized exchange protocol built on the Ethereum blockchain. $UNI tokens provide users with governance rights, allowing them to participate in decision-making processes related to the platform’s future.

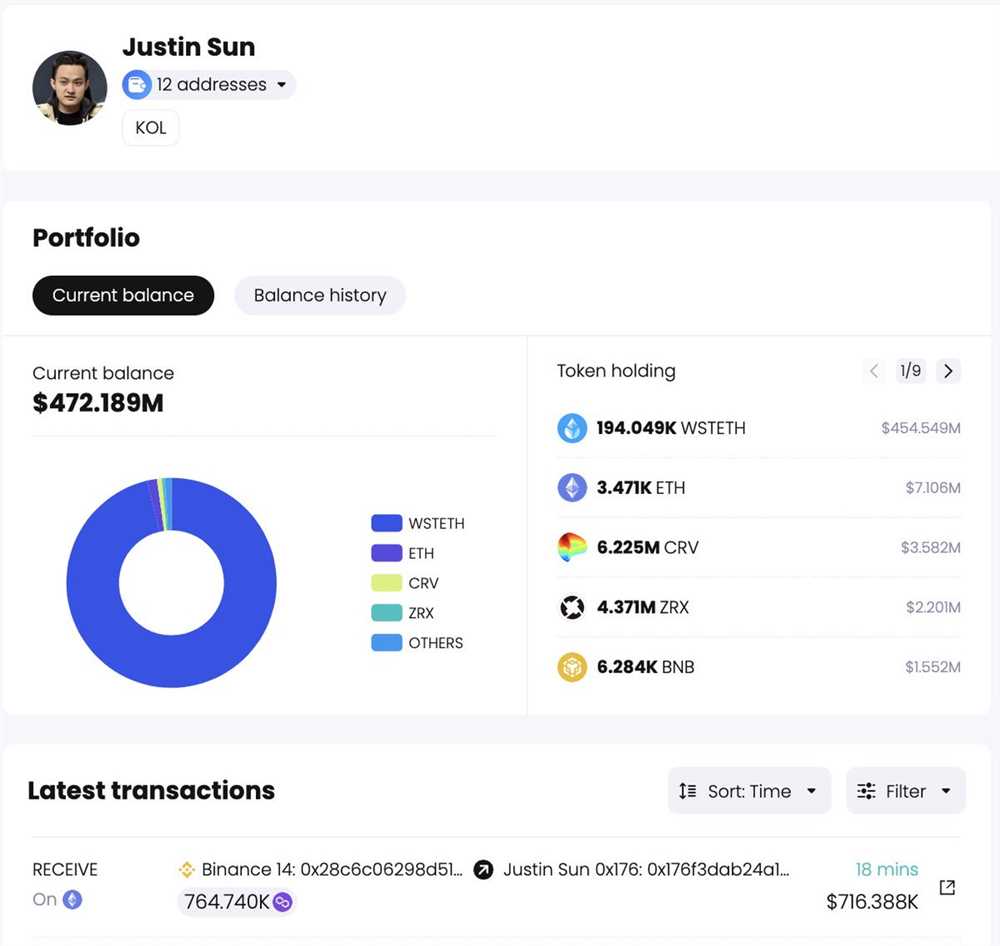

The 1inch Investment Fund

The 1inch Investment Fund is a leading cryptocurrency investment vehicle that specializes in identifying and capitalizing on emerging opportunities in the decentralized finance (DeFi) space. With a track record of successful investments, the Fund aims to maximize returns for its investors through strategic buying and selling of various cryptocurrencies, including $UNI tokens.

By selling 416,924 $UNI tokens, the 1inch Investment Fund demonstrates its commitment to actively manage its portfolio and optimize risk-reward dynamics. This sale presents an opportunity for investors to benefit from the Fund’s expertise and potentially generate returns.

It is important to note that the sale of $UNI tokens by the 1inch Investment Fund can impact the market price of the tokens, potentially resulting in a loss. However, the Fund’s experienced team closely monitors market trends and executes trades based on careful analysis to maximize potential gains.

Take Advantage of this Opportunity

If you are looking to diversify your cryptocurrency holdings or participate in the ever-growing DeFi market, the sale of 416,924 $UNI tokens presents an opportunity worth considering. The 1inch Investment Fund’s proven track record and strategic approach to investment make it an attractive option for those seeking exposure to the exciting world of decentralized finance.

Don’t miss out on this limited-time opportunity. Contact the 1inch Investment Fund today to learn more about acquiring $UNI tokens and potentially benefiting from their future value.

Details:

The 1inch Investment Fund has recently sold 416,924 $UNI tokens, potentially at a loss. Here are the details of the transaction:

Selling Price:

- The tokens were sold at a reduced price of $10 per token.

Potential Loss:

The sale of these tokens may have resulted in a loss for the fund. The potential loss will depend on the initial purchase price of the tokens.

Reason for Selling:

The decision to sell the $UNI tokens was based on market analysis and the fund’s investment strategy. The fund may have identified better investment opportunities or needed to rebalance its portfolio.

Investment Fund Strategy:

- The 1inch Investment Fund aims to maximize returns by actively managing its portfolio.

- The fund invests in various cryptocurrencies and blockchain-related projects.

- Risk management and diversification are key elements of the fund’s strategy.

- The fund closely monitors market trends and adjusts its holdings accordingly.

Disclaimer: This information is provided for informational purposes only and should not be considered financial advice. Investors should conduct their own research and consult with a financial advisor before making any investment decisions.

Potential Loss from the Sale

While the 1inch Investment Fund has successfully sold 416,924 $UNI tokens, it is important to acknowledge the potential loss associated with this sale. Market conditions and the fluctuating value of cryptocurrencies can significantly impact the profitability of any investment.

Market Volatility

The cryptocurrency market is known for its volatility, with prices often experiencing rapid and significant fluctuations. As a result, the value of $UNI tokens at the time of the sale may have been lower than their original acquisition price. This could potentially result in a loss for the 1inch Investment Fund.

Selling at the Wrong Time

The timing of the sale is crucial when it comes to maximizing profits or minimizing losses. It is possible that the 1inch Investment Fund sold their $UNI tokens when the market conditions were not favorable, leading to a potential loss. Predicting the optimal time to sell is challenging, and even experienced investors can make mistakes in their timing decisions.

It is important to understand that investing in cryptocurrencies involves inherent risks, with the potential for both profits and losses. While the 1inch Investment Fund may have incurred a loss from the sale of $UNI tokens, it is a valuable learning experience that can help inform future investment decisions.

Disclaimer: This information is for educational purposes only and should not be considered financial advice. Investing in cryptocurrencies carries a level of risk, and individuals should conduct their own research and seek professional advice before making any investment decisions.

Analysis:

The recent sale of 416,924 $UNI tokens by the 1inch Investment Fund has raised eyebrows within the crypto community. The decision to sell such a significant number of tokens has left many questioning the fund’s strategy and potential implications for the market.

One key aspect to consider is the timing of the sale. With the crypto market experiencing a period of volatility, selling $UNI tokens at this point may be seen as a hasty decision. It is possible that the 1inch Investment Fund is concerned about potential losses and is looking to cut its losses before further price drops occur.

Another factor to take into account is the potential impact on the market. Selling such a large number of tokens could potentially lead to a decrease in the value of $UNI tokens. This may create a negative perception among investors and impact the overall market sentiment. It remains to be seen how the market will react to this sale and what the long-term consequences will be.

Furthermore, the reason behind the sale is also worth analyzing. It is unclear why the 1inch Investment Fund decided to sell the $UNI tokens at this specific moment. Without further information, it is difficult to determine whether this was a strategic move or simply a reaction to market conditions.

Overall, the sale of 416,924 $UNI tokens by the 1inch Investment Fund has raised questions and sparked speculation within the crypto community. The market’s response to this sale and the potential implications for the value of $UNI tokens remain uncertain. It will be interesting to observe how this situation unfolds and what it may indicate for the broader cryptocurrency market.

Question-answer:

What is the 1inch Investment Fund?

The 1inch Investment Fund is a fund that invests in various cryptocurrencies and digital assets on behalf of its investors.

Why did the 1inch Investment Fund sell $UNI tokens?

The 1inch Investment Fund sold $UNI tokens in order to realize gains or losses on its investment and rebalance its portfolio.

How many $UNI tokens did the 1inch Investment Fund sell?

The 1inch Investment Fund sold a total of 416,924 $UNI tokens.