Galaxy price movement has always been a topic of great interest and speculation in the financial world. Investors and traders alike closely monitor the factors that influence the price of galaxies, as these celestial bodies hold immense value and can fetch significant returns.

Understanding the various factors that impact galaxy prices is crucial for making informed investment decisions. This comprehensive analysis aims to explore the key factors that drive galaxy price movement and shed light on the intricate dynamics of the galactic market.

One of the primary factors influencing galaxy price movement is the law of supply and demand. Just like any other asset, galaxies are subject to the basic economic principle that dictates that as demand increases and supply decreases, prices tend to rise. However, the scarcity of galaxies, especially those with unique characteristics or historical significance, can further intensify their value and drive prices to astronomical levels.

Another significant factor that affects galaxy prices is technological advancements. The development of more advanced telescopes and space exploration technologies has made it easier for scientists and enthusiasts to discover and study galaxies. As our knowledge and understanding of galaxies expand, the demand for rare and exotic specimens increases, leading to a surge in their prices.

Factors Affecting the Price of Galxe: An In-Depth Analysis

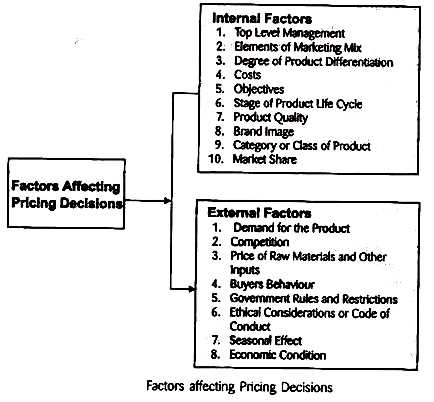

The price of Galxe, a digital currency, is subject to a variety of factors that can influence its value in the market. Understanding these factors is crucial for investors and traders to make informed decisions about buying or selling Galxe.

1. Supply and Demand: Like any other asset, the price of Galxe is affected by the fundamental economic principle of supply and demand. When the demand for Galxe exceeds its available supply, the price tends to increase, and vice versa.

2. Market Sentiment: The overall sentiment or mood of investors and traders towards Galxe can greatly impact its price. Positive news, such as partnerships or adoption by major companies, can drive up the price, while negative news, such as regulatory concerns or security breaches, can lead to a decline in price.

3. Regulatory Developments: Government regulations and policies regarding cryptocurrencies can have a significant impact on the price of Galxe. Favorable regulations, such as the recognition of Galxe as a legal form of payment, can boost its price, while strict regulations or bans can lead to a decrease in price.

4. Technology Advancements: Technological advancements related to Galxe, such as improvements in its underlying blockchain technology or the development of new features, can positively influence its price. These advancements often increase its utility and attract more investors.

5. Market Liquidity: The liquidity of the Galxe market, which refers to the ease of buying and selling Galxe without causing significant price fluctuations, can affect its price. Higher liquidity tends to result in more stable prices, while lower liquidity can make the price more volatile.

6. Market Manipulation: Cryptocurrency markets are susceptible to manipulation by large traders or whales. These individuals or groups can manipulate the price of Galxe through practices such as pump and dump schemes, which can lead to sudden price fluctuations.

7. Global Economic Factors: Global economic factors, such as inflation, interest rates, and geopolitical events, can indirectly affect the price of Galxe. Economic instability or uncertainty can drive investors towards cryptocurrencies as a store of value, potentially increasing the demand and price of Galxe.

| Factors | Description |

|---|---|

| Supply and Demand | When demand exceeds supply, the price increases. |

| Market Sentiment | Investor perception and mood towards Galxe. |

| Regulatory Developments | Government regulations and policies. |

| Technology Advancements | Improvements in underlying blockchain technology. |

| Market Liquidity | The ease of buying and selling Galxe. |

| Market Manipulation | Large traders or whales manipulating the price. |

| Global Economic Factors | Inflation, interest rates, and geopolitical events. |

Overall, a comprehensive understanding of these factors is crucial to assess the potential price movements of Galxe. By keeping a close eye on these influences, investors and traders can better navigate the Galxe market and make informed decisions.

Economic Factors and their Impact on Galxe Price Movement

Galxe price movement is influenced by a variety of economic factors. Understanding how these factors contribute to fluctuations in the price of Galxe can help investors make more informed decisions regarding their investments. In this section, we will explore some of the key economic factors that impact Galxe price movement.

Supply and Demand

One of the primary economic factors that affects Galxe price movement is the balance between supply and demand. When the demand for Galxe exceeds the available supply, the price tends to increase. Conversely, when the supply of Galxe outweighs the demand, the price tends to decrease. Understanding the dynamics of supply and demand is crucial for predicting Galxe price movements.

Market Speculation

Market speculation can greatly impact Galxe price movement. Investors and traders often speculate on the future price of Galxe based on various factors such as news events, market trends, and investor sentiment. Speculation can create volatility in the market and cause the price of Galxe to fluctuate significantly.

Factors such as government regulations, economic policies, and geopolitical events can also influence Galxe price movement. For example, if a government announces favorable regulations for cryptocurrency, it can lead to an increased demand for Galxe and drive up its price. On the other hand, negative news or unfavorable regulations can have an adverse effect on Galxe price movement.

In conclusion, economic factors play a significant role in determining Galxe price movement. Supply and demand dynamics, market speculation, government regulations, and geopolitical events all contribute to the fluctuations in Galxe price. By closely monitoring these factors, investors can better understand and anticipate Galxe price movements.

Technological Advancements and their Influence on Galxe Prices

Technological advancements have played a significant role in shaping the market dynamics of the Galxe industry. These advancements have had a direct impact on production, distribution, and demand, which ultimately influence Galxe prices. In this section, we will explore some key technological advancements and their influence on Galxe prices.

Rapid Innovations in Extraction Techniques

One of the most significant technological advancements in the Galxe industry is the development of new extraction techniques. Traditional methods of extraction were time-consuming, labor-intensive, and expensive. However, with the advent of advanced extraction techniques such as hydrocarbon solvent extraction and supercritical fluid extraction, the efficiency and cost-effectiveness of Galxe extraction have significantly improved. These advancements have led to increased Galxe supply, reduced production costs, and ultimately, lower Galxe prices.

Advancements in Storage and Transportation

The storage and transportation of Galxe have also benefited from technological advancements. Improved storage facilities, such as cryogenic tanks, have made it easier to preserve and transport Galxe without any significant loss. Furthermore, the development of advanced transportation methods, including pipelines and cryogenic trucks, has increased the efficiency of Galxe delivery from extraction sites to end-users. These advancements in storage and transportation have not only decreased the risk of Galxe spoilage but have also lowered transportation costs, contributing to the overall reduction in Galxe prices.

Furthermore, the adoption of blockchain technology in the Galxe industry has brought about significant changes in pricing and transactions. Blockchain technology enables transparent and secure transactions, eliminating the need for intermediaries and reducing transaction costs. This technology has provided a level of trust and efficiency that was previously unattainable in the Galxe market.

As technology continues to evolve, it is expected that further advancements in areas such as Galxe purification, environmental impact mitigation, and efficient resource allocation will continue to influence Galxe prices. It is imperative for market participants to stay updated with these technological advancements to adapt to the changing landscape and make informed decisions regarding Galxe investments.

In conclusion, technological advancements have had a transformative impact on the Galxe industry, affecting various aspects such as extraction, storage, transportation, and pricing. These advancements have led to increased Galxe supply, reduced production costs, improved efficiency in storage and transportation, and introduced innovative pricing mechanisms. As technology continues to progress, it will be exciting to observe how further advancements shape the Galxe market and its prices.

Market Sentiment and its Role in Galxe Price Volatility

Market sentiment, also known as investor psychology or investor sentiment, plays a significant role in the price volatility of Galxe. It reflects the overall attitude or feeling of market participants towards this digital asset. Market sentiment can be influenced by a variety of factors such as economic indicators, news events, social media discussions, and investor expectations.

Fear and Greed

One of the key emotions driving market sentiment is fear. When investors are fearful, they tend to sell their Galxe holdings, leading to a decrease in its price. This fear can be triggered by negative news, economic uncertainty, or a general pessimistic outlook on the market. On the other hand, greed can fuel a positive market sentiment. When investors are greedy, they tend to buy more Galxe, driving its price up.

It’s important to note that fear and greed are not rational reactions, but rather emotional responses that can cause prices to move irrationally.

Sentiment Indicators

To gauge market sentiment, analysts and traders often rely on sentiment indicators. These indicators provide insights into the overall mood of the market and help predict potential price movements. Some commonly used sentiment indicators for Galxe include:

- Social Media Sentiment: Analyzing the sentiment expressed in social media discussions can provide valuable insights into public sentiment towards Galxe. Positive or negative sentiment in social media posts can influence investor perception and subsequently impact price volatility.

- News Sentiment: Monitoring news articles and headlines can help assess the sentiment of media coverage surrounding Galxe. Positive or negative news can sway investor sentiment and trigger buying or selling pressure.

- Option Market Sentiment: Analyzing the trading activity and positioning in Galxe options can offer clues about market sentiment. For example, a higher demand for call options may indicate bullish sentiment, while a higher demand for put options may indicate bearish sentiment.

- Volatility Index: The Galxe Volatility Index, also known as the fear index or VIX, measures market expectations of near-term volatility. An increase in the VIX suggests a rise in market uncertainty and potentially negative sentiment.

By analyzing these sentiment indicators, traders and investors can gain insights into the prevailing market sentiment and make more informed decisions.

In conclusion, market sentiment is a crucial factor influencing Galxe price volatility. It reflects the emotional reactions of market participants towards this digital asset and can be driven by fear and greed. Traders and investors can use various sentiment indicators to assess market sentiment and make informed decisions based on the prevailing sentiment.

Question-answer:

What are the main factors influencing galaxy price movement?

The main factors influencing galaxy price movement include supply and demand dynamics, market sentiment, technological advancements, and macroeconomic factors.

How does supply and demand dynamics affect galaxy prices?

Supply and demand dynamics play a significant role in determining galaxy prices. When there is a high demand for galaxies and a limited supply, prices tend to rise. Conversely, when there is a low demand and a high supply, prices tend to decrease.

What role does market sentiment play in galaxy price movement?

Market sentiment, or the overall attitude and feeling of investors towards the market, can greatly impact galaxy price movement. Positive market sentiment can drive up prices as investors are optimistic about the future potential of galaxies. Conversely, negative market sentiment can lead to a decrease in prices as investors become more cautious and less willing to buy.