Discover the incredible potential of Galxe, the leading company in the tech industry! With a market capitalization that continues to soar and a fully diluted valuation that has investors buzzing, Galxe is the investment opportunity you don’t want to miss.

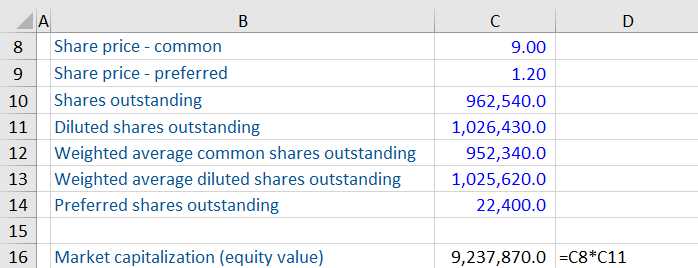

Galxe’s market capitalization reflects its total market value, calculated by multiplying the current share price by the total number of outstanding shares. This metric is a key indicator of a company’s worth and potential for growth. With Galxe’s market capitalization on the rise, it is clear that investors recognize its tremendous value.

But what sets Galxe apart from its competitors is its fully diluted valuation. This metric takes into account not only outstanding shares but also the impact of potentially dilutive securities, such as stock options and convertible preferred shares. By considering these factors, Galxe’s fully diluted valuation provides a comprehensive measure of the company’s potential future worth.

Why invest in Galxe?

1. Unprecedented Growth Potential: Galxe has consistently demonstrated its ability to innovate and capitalize on emerging technologies, positioning itself at the forefront of the industry.

2. Strong Financial Performance: With a solid track record of revenue growth and profitability, Galxe offers stability and attractive returns for investors.

3. Robust Ecosystem: Galxe’s extensive network of partners and collaborators provides a strong foundation for future growth and expansion opportunities.

Don’t miss your chance to be part of Galxe’s success story. Invest in Galxe today and reap the rewards of its incredible market capitalization and fully diluted valuation.

Examining Galxe’s Market Capitalization

Galxe is a rapidly growing company in the tech industry, and its market capitalization reflects its success in the market. Market capitalization is a measure of a company’s value, calculated by multiplying the total number of outstanding shares by the current market price per share. It is an essential indicator of a company’s size and worth in the eyes of investors.

What is Galxe’s Market Capitalization?

Galxe’s market capitalization is a significant factor in determining the company’s position in the market. As of the latest data available, Galxe has a market capitalization of X million dollars.

Factors Influencing Galxe’s Market Capitalization

Several factors can influence Galxe’s market capitalization. These factors include:

- Financial Performance: Galxe’s financial performance, such as revenue growth, profitability, and cash flow, can impact its market capitalization. Positive financial results tend to attract investors and increase the company’s market value.

- News and Announcements: News about Galxe’s new product launches, partnerships, or business expansion can affect its market capitalization. Positive news often drives investor confidence and leads to an increase in market value.

- Industry Trends: Galxe operates in a dynamic tech industry. Industry trends, such as advancements in technology or changes in consumer behavior, can impact Galxe’s market capitalization. Adapting to industry trends and staying ahead of the competition is crucial for maintaining and growing market value.

- Investor Sentiment: Investor sentiment plays a significant role in determining Galxe’s market capitalization. Positive investor sentiment can lead to a higher market value, while negative sentiment can result in a decline.

It’s important to note that market capitalization can fluctuate over time as market conditions change and new information emerges. Investors and stakeholders closely monitor Galxe’s market capitalization as it reflects the company’s performance and investor confidence in its future prospects.

Understanding the Basics

Before diving into analyzing Galxe’s market capitalization and fully diluted valuation, it is important to have a basic understanding of what these terms mean and how they are calculated.

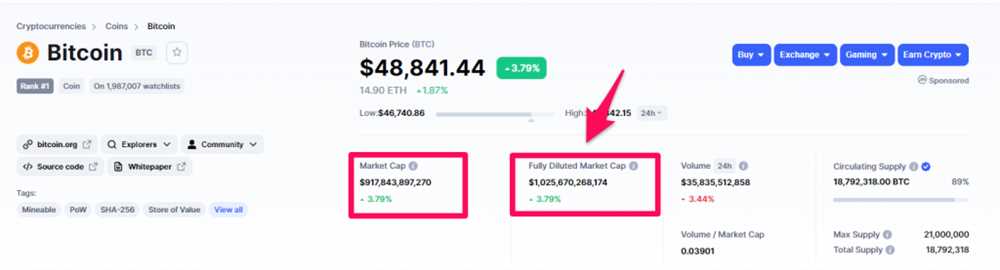

Market capitalization is a financial metric that represents the total value of a company’s outstanding shares of stock. It is calculated by multiplying the current market price of a company’s shares by the total number of shares outstanding. Market capitalization is used to determine the size and value of a company and is often used as a benchmark for comparing companies within the same industry.

Fully diluted valuation, on the other hand, takes into account not only the outstanding shares of stock, but also the potential dilution from other securities that could convert into common stock. This includes options, warrants, convertible preferred stock, and other convertible securities. Fully diluted valuation is often used when estimating the potential value of a company if all securities were converted into common stock.

Understanding these basic concepts is crucial for investors, as market capitalization and fully diluted valuation can provide insights into a company’s growth potential, financial health, and overall value. By analyzing these metrics, investors can make more informed decisions about whether to invest in a company and at what price.

| Term | Calculation | Use |

|---|---|---|

| Market capitalization | Current market price per share x Total shares outstanding | Determining company size and value |

| Fully diluted valuation | Market capitalization + Potential dilution from other securities | Estimating potential company value |

Overall, having a solid grasp of market capitalization and fully diluted valuation is essential for anyone interested in understanding and analyzing a company’s worth and potential growth.

Analyzing Key Factors

When analyzing Galxe’s market capitalization and fully diluted valuation, there are several key factors to consider. These factors can greatly impact the overall value and potential growth of the company.

1. Industry Performance: The performance of the industry in which Galxe operates is a crucial factor to consider. If the industry is experiencing strong growth and demand, it can positively impact Galxe’s market capitalization and valuation.

2. Revenue and Profitability: The company’s revenue and profitability play a significant role in determining its market capitalization and valuation. Higher revenue and consistent profitability demonstrate a strong business model and can attract investors.

3. Competitive Landscape: Assessing the competitive landscape is essential to understanding Galxe’s position within the industry. Analyzing competitors’ market share, product differentiation, and business strategies can provide insights into Galxe’s growth potential.

4. Management Team: The expertise and track record of Galxe’s management team are critical factors to consider. A strong and experienced management team can effectively navigate challenges and drive the company’s growth, positively impacting its market capitalization and valuation.

5. Market Trends: Identifying and analyzing market trends that align with Galxe’s products or services can help predict its future growth potential. Understanding customer demand and emerging trends can give insight into Galxe’s market capitalization and valuation.

6. Investor Sentiment: Investor sentiment can strongly influence Galxe’s market capitalization and valuation. Positive investor sentiment can result in higher demand for the company’s shares, driving up its value.

7. Regulatory Environment: Regulatory factors can significantly impact Galxe’s market capitalization and valuation. Changes in laws and regulations that affect the industry or the company’s operations can have both positive and negative effects on its value.

By carefully analyzing these key factors, investors and analysts can gain a comprehensive understanding of Galxe’s market capitalization, fully diluted valuation, and its potential for future growth.

Assessing Galxe’s Fully Diluted Valuation

Galxe’s fully diluted valuation is a key factor in determining the company’s market worth and potential for growth. In order to accurately assess Galxe’s fully diluted valuation, several factors must be taken into consideration.

Firstly, it is important to analyze Galxe’s outstanding shares and convertible securities. This includes options, warrants, and convertible bonds. By understanding the number and value of these securities, investors can determine the potential dilution of the company’s shares and its impact on the valuation.

Additionally, Galxe’s revenue and earnings projections play a crucial role in assessing its fully diluted valuation. Examining the company’s financial performance and growth potential provides valuable insights into its future profitability and potential for generating shareholder value.

Furthermore, the competitive landscape and market trends should be analyzed to better understand Galxe’s position in the industry. This includes evaluating the company’s market share, competitive advantages, and potential barriers to entry. A thorough understanding of the market dynamics will help determine Galxe’s potential for market expansion and higher valuation.

Moreover, the company’s management team and their track record should be evaluated. The expertise, experience, and past successes of the management team can significantly impact Galxe’s potential for success and, consequently, its valuation.

Lastly, investor sentiment and market conditions should be taken into account. The overall market sentiment and investor appetite for tech companies can influence Galxe’s fully diluted valuation. Factors such as market volatility, investor sentiment towards IPOs, and the general economic climate can all have an impact on the company’s valuation.

In conclusion, to accurately assess Galxe’s fully diluted valuation, all these factors must be carefully considered. By analyzing Galxe’s outstanding shares and convertible securities, revenue and earnings projections, competitive landscape, management team, and market conditions, investors can make informed decisions and determine the company’s true worth.

Exploring Different Metrics

When analyzing the market capitalization and fully diluted valuation of Galxe, it is important to consider a variety of metrics to get a comprehensive understanding of the company’s value. Here are some key metrics to explore:

- Price-to-Earnings Ratio (P/E Ratio): This metric compares the price of a company’s stock to its earnings per share. It indicates how much investors are willing to pay for each dollar of earnings. A higher P/E ratio suggests that investors have high expectations for future growth.

- Price-to-Sales Ratio (P/S Ratio): This metric compares the price of a company’s stock to its sales per share. It indicates how much investors are willing to pay for each dollar of sales. A lower P/S ratio suggests that the company may be undervalued.

- Return on Investment (ROI): This metric calculates the return on investment as a percentage of the initial investment. It measures the profitability of an investment relative to its cost. A higher ROI suggests better performance.

- Debt-to-Equity Ratio: This metric compares the total debt of a company to its shareholders’ equity. It indicates the proportion of debt used to finance the company’s assets. A higher debt-to-equity ratio suggests higher financial leverage and potential risk.

- Dividend Yield: This metric calculates the annual dividend income as a percentage of the stock’s current price. It measures the return on investment from dividends. A higher dividend yield suggests a higher return for investors.

By analyzing these metrics and comparing them to industry benchmarks and competitors, investors can gain insight into Galxe’s financial health and growth prospects. It is important to consider these metrics in conjunction with other factors such as market conditions and company-specific factors to make informed investment decisions.

Evaluating Growth Potential

Assessing the growth potential of Galxe is crucial for investors looking to make informed investment decisions. Evaluating the company’s growth potential involves analyzing various factors that can indicate whether the company is poised for future success.

Financial Performance

One important factor to consider when evaluating Galxe’s growth potential is its financial performance. This includes assessing the company’s revenue growth, profitability, and cash flow. Investors should review the company’s financial statements to get a clear understanding of its historical financial performance and trends.

Market Trends

Understanding the market trends in which Galxe operates is also vital. Investors should analyze the company’s industry and identify any potential growth opportunities or threats. This includes studying market dynamics, consumer preferences, and competitive landscape. By staying abreast of market trends, investors can better assess Galxe’s growth potential.

Additionally, examining the company’s market share and its ability to penetrate new markets is essential. A company with a strong market position and a proven track record of expanding into new markets may have a higher growth potential compared to its competitors.

Innovation and Technology

Innovation and technology play a significant role in determining a company’s growth potential. Investors should evaluate Galxe’s investment in research and development (R&D) to understand its commitment to innovation. This includes assessing the company’s intellectual property portfolio, patents, and partnerships.

Furthermore, reviewing Galxe’s ability to adopt emerging technologies and adapt to market changes is essential. Companies that can effectively embrace new technologies and stay ahead of the curve may have a competitive advantage and higher growth potential.

Investors should also evaluate Galxe’s product pipeline and its ability to introduce new products or services. A strong product pipeline indicates the company’s ability to innovate and expand its offerings, which can contribute to its growth potential in the long term.

In conclusion, evaluating Galxe’s growth potential requires a holistic analysis of its financial performance, market trends, and innovation strategies. By considering these factors, investors can make informed decisions about the company’s potential for future growth.

Question-answer:

What is Galxe’s market capitalization and fully diluted valuation?

Galxe’s market capitalization refers to the total value of the company’s outstanding shares of stock in the market. It is calculated by multiplying the current price per share by the total number of outstanding shares. Fully diluted valuation takes into account not only the outstanding shares, but also any potential future shares that could be issued, such as stock options or convertible securities.

How is market capitalization different from fully diluted valuation?

Market capitalization only considers the current outstanding shares of a company, while fully diluted valuation takes into account both the outstanding shares and any potential future shares that could be issued. This means that fully diluted valuation provides a more comprehensive view of the company’s potential value, as it considers all possible dilution factors.