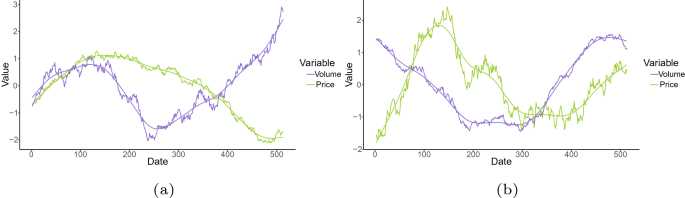

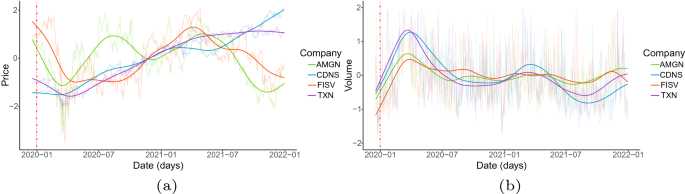

When it comes to investing in the stock market, one of the most crucial factors to consider is price changes and market volume. These two elements play a significant role in determining the potential profitability and stability of a stock. For this reason, evaluating Galxe, a leading company in the technology sector, is of utmost importance.

Galxe, an innovative tech firm known for its groundbreaking products and services, has been making waves in the market with its consistent growth and impressive financial performance. By analyzing the price changes and market volume of Galxe stocks, investors can gain valuable insights into the company’s market position and future prospects.

Understanding the price changes of Galxe stocks is vital for investors as it reflects the market’s perception of the company’s value. A significant increase in price over a short period can indicate positive developments or investor optimism, while a decline may signify negative news or declining market confidence. By examining these price changes, market participants can make informed decisions about buying or selling Galxe stocks.

Market volume, on the other hand, refers to the total number of shares traded within a specific timeframe. It serves as an indicator of investor interest and liquidity in Galxe stocks. Higher market volume suggests a higher level of market activity and can indicate widespread investor participation. Analyzing market volume helps investors gauge the level of demand or supply for Galxe stocks, allowing them to make well-informed decisions based on market sentiment.

By evaluating the price changes and market volume of Galxe stocks, investors can assess the company’s attractiveness as an investment opportunity. Price changes reveal market sentiment, while market volume reflects investor participation. Both of these factors combined provide valuable insights into Galxe’s market position, potential risks, and future growth prospects.

Growth Potential of Galxe

Galxe, a digital currency, has shown significant growth potential in recent years. With its innovative blockchain technology and increasing adoption, Galxe is poised to become a prominent player in the cryptocurrency market.

1. Technological Advancements

One of the key factors contributing to Galxe’s growth potential is its technological advancements. Galxe utilizes a sophisticated blockchain system that ensures secure and transparent transactions. The use of smart contracts allows for automated and efficient transfers, making Galxe an attractive option for businesses and individuals alike.

Furthermore, Galxe’s blockchain technology offers scalability and faster transaction times compared to traditional financial systems. As more individuals and businesses recognize the advantages of these technological advancements, the demand for Galxe is likely to increase, leading to further growth in its value.

2. Growing Adoption

As Galxe gains recognition and trust in the market, its adoption rate is steadily increasing. More merchants are beginning to accept Galxe as a form of payment, providing users with greater flexibility and usability. This growing acceptance and integration of Galxe into the mainstream economy will further enhance its growth potential.

Moreover, Galxe has a strong community of supporters and developers who actively contribute to its ecosystem. This active participation fosters innovation and enhances the platform’s usability, attracting more users and investors.

3. Market Demand

The demand for Galxe is driven by several factors, including its utility value and potential investment opportunities. As more individuals realize the benefits of using Galxe for transactions, the demand for the digital currency will increase.

Furthermore, Galxe’s limited supply contributes to its growth potential. With a finite number of coins available, as the demand rises, the scarcity of Galxe will likely increase its value. This scarcity creates an incentive for individuals to invest in Galxe, anticipating future price appreciation.

- Faster transaction times and increased scalability

- Greater acceptance and integration into the mainstream economy

- Active community and developer support

- Utility value and potential investment opportunities

- Limited supply, creating scarcity and potential price appreciation

In conclusion, Galxe has demonstrated significant growth potential due to its technological advancements, growing adoption, and market demand. As these factors continue to evolve, Galxe is expected to further establish itself as a prominent player in the cryptocurrency market.

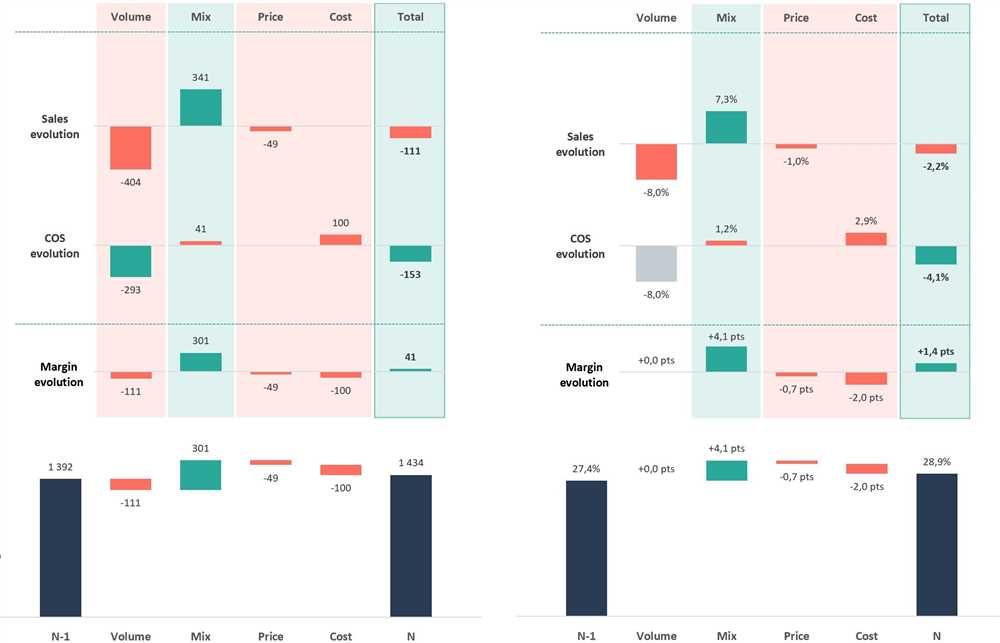

Impact of Price Changes on Galxe

Price changes play a crucial role in the performance and behavior of any financial market, including Galxe. The fluctuation in prices can have a significant impact on the overall market sentiment and trading activity. Here are some key insights into how price changes affect Galxe:

- Market Volatility: Price changes often lead to increased market volatility. When prices experience large and rapid fluctuations, it tends to create an atmosphere of uncertainly and apprehension among traders. This can result in higher trading volumes, as participants might look to capitalize on the price movements.

- Investor Sentiment: Price changes can influence investor sentiment towards Galxe. A significant increase in prices could generate optimism and attract more investors, as they perceive the market to be performing well. Conversely, a sharp decline in prices may cause fear and discourage potential investors from entering the market.

- Trading Strategies: Price changes often prompt traders to adjust their trading strategies. For example, if prices are rapidly rising, traders might adopt a bullish stance and look for buying opportunities. Conversely, if prices are falling, traders might adopt a bearish stance and seek selling opportunities to profit from the downward movement.

- Liquidity: Price changes can impact the liquidity of Galxe. When prices are stable or moving within a narrow range, liquidity tends to be lower as there might be fewer active participants in the market. However, during periods of price volatility, liquidity tends to increase as more traders enter the market to take advantage of the price movements.

- Market Orders: Price changes can influence the execution of market orders. If prices are constantly changing, traders might experience slippage, where the executed price differs from the expected price due to the speed at which the market is moving. This is particularly relevant for traders using market orders, as they are executed at the prevailing market price.

Overall, price changes are a fundamental aspect of Galxe and have a significant impact on various market dynamics, including market sentiment, trading activity, and liquidity. Monitoring and analyzing price changes can provide valuable insights for traders and investors in making informed decisions and managing risks.

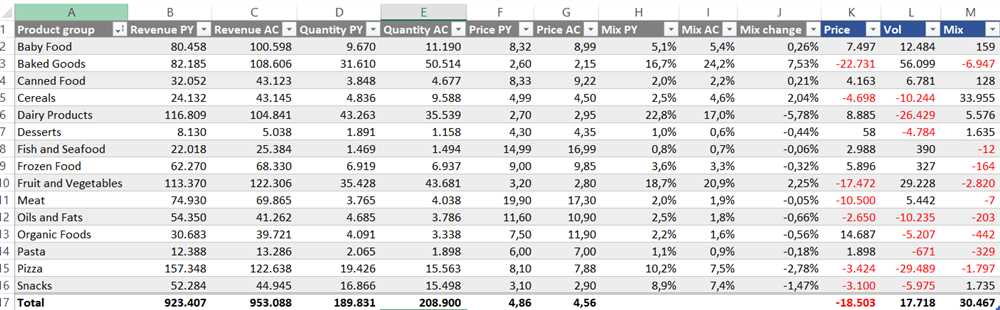

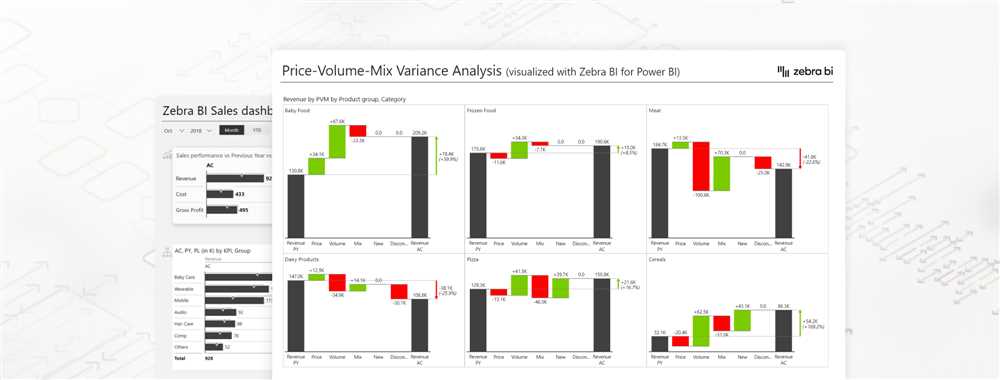

Market Volume Analysis for Galxe

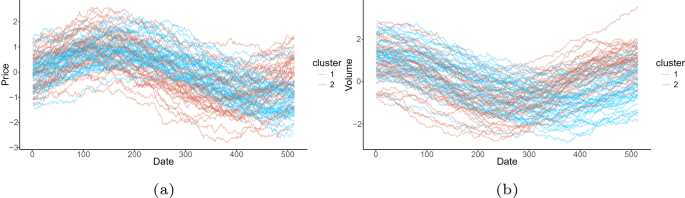

Market volume analysis is an essential tool for understanding the level of activity in a particular market. By analyzing the trading volume of Galxe, we can gain insights into the market’s liquidity and the interest of investors in the asset.

Understanding Market Volume

Market volume refers to the number of shares or contracts traded in a specific security or market during a given period of time. It is a measure of the overall activity in the market and provides an indication of the level of interest and participation from buyers and sellers.

High trading volume suggests a high level of market activity, indicating that many investors are buying and selling Galxe. Conversely, low trading volume indicates reduced interest and limited market activity. Analyzing market volume over time can help identify trends and patterns that may provide valuable insights for traders and investors.

Implications for Galxe

Analyzing the market volume for Galxe can provide valuable information about the asset’s liquidity and the sentiment of market participants. High trading volume may indicate strong interest in Galxe, potentially suggesting a bullish sentiment among investors.

On the other hand, low trading volume may indicate a lack of interest or limited market participation in Galxe. This could be a red flag for investors, as it may indicate a lack of liquidity and difficulty in buying or selling the asset without significant price fluctuations.

Additionally, changes in market volume can be used to identify significant events or news that may have an impact on the price and sentiment surrounding Galxe. If there is a sudden increase in trading volume, it may indicate that new information has been released, causing a surge of interest and activity in the market.

Overall, market volume analysis is an important tool for evaluating the level of interest and activity in the Galxe market. By understanding market volume trends, traders and investors can make informed decisions and gain a deeper understanding of the dynamics and sentiment driving Galxe’s price movements.

Question-answer:

How can I evaluate Galxe?

To evaluate Galxe, you can analyze its price changes and market volume. Price changes can give you an idea of how the market perceives Galxe’s value. If the price is increasing, it indicates positive sentiment and demand for the asset. On the other hand, a decreasing price may indicate negative sentiment and lack of demand. Market volume, on the other hand, represents the number of shares being traded. Higher volume generally indicates increased activity and interest in the asset.

What factors should I consider when analyzing price changes and market volume of Galxe?

When analyzing price changes and market volume of Galxe, there are several factors to consider. Firstly, you should look at the overall market trends and sentiment. If the overall market is bullish and positive, it may have a positive impact on Galxe’s price and volume. Additionally, you should consider any news or announcements related to Galxe and its industry. Positive news can drive up price and volume, while negative news can have the opposite effect. Finally, it’s important to compare Galxe’s price and volume with its competitors or similar assets, as it can provide further insights into its performance.